[ad_1]

A fair amount of news happened last week: The Federal Reserve announced it is still nowhere close to issuing a digital dollar and the U.S. House of Representatives held a surprisingly substantive discussion around crypto’s energy impact.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Blockchain bucks

The narrative

The U.S. Federal Reserve finally published its central bank digital currency (CBDC) report! The long-awaited missive outlined the Fed’s chief questions about CBDCs and provided a window into its thinking on the issue.

Why it matters

The Fed is finally giving us a good look at how it’s approaching CBDCs. What’s more, the central bank wants the general public to weigh in.

Breaking it down

So, first off: I’m still not convinced the Fed actually wants to issue a central bank digital currency.

The Fed doesn’t commit one way or another on whether or not it wants to create a CBDC in the report published last week. This is no surprise. Fed Chair Jerome Powell has said as much on numerous occasions.

From this view, nothing in the report was really new. The Fed is looking at privacy issues, financial stability concerns, practical applications and whether there really is a need for a digital dollar. Powell has outlined these same questions in various confessional hearings.

In the Fed’s view, a hypothetical digital dollar would essentially be a digital analog to the current financial system, with the Fed issuing the currency but intermediaries giving retail users access.

“The Federal Reserve’s initial analysis suggests that a potential U.S. CBDC, if one were created, would best serve the needs of the United States by being privacy protected, intermediated, widely transferable, and identity verified. As noted above, however, the paper is not intended to advance a specific policy outcome and takes no position on the ultimate desirability of a U.S. CBDC,” the report said.

(It’s worth noting that this report is separate from what the Boston Fed and MIT might publish. That project is looking at technical bases for central bank digital currencies, rather than the policy questions around issuing one.)

Also, we didn’t learn that the Fed still really wants Congress to authorize a CBDC before it’ll take any action toward doing so. Again, we knew this. What’s more, even if Congress does authorize a digital dollar, the Fed announced that last week’s report is just the first step in a “broad consultation,” implying a lengthy outreach process.

Speaking of which, members of the public can weigh in before May 2022 if they so choose. The Fed has a list of 22 questions, and responses can be sent via a web portal.

Despite how much of this report wasn’t too new, a few details stood out.

The first is the Fed’s desire to play a role in guiding CBDC development elsewhere in the world.

“Irrespective of any ultimate conclusion, Federal Reserve staff will continue to play an active role in developing international standards for CBDCs,” the report said.

Part of this international coordination would be to help cross-border payments, per the report. But the real key here seems to be a desire to maintain the dollar hegemony within the global financial system.

“The dollar’s international role also allows the United States to influence standards for the global monetary system,” the report noted.

The Fed’s approach to privacy is also going to be a bit of a sticking point.

The central bank wants to make sure that a CBDC is transacted through entities with the proper know-your-customer (KYC) and anti-money laundering (AML) frameworks in place.

“A general-purpose CBDC would generate data about users’ financial transactions in the same ways that commercial bank and nonbank money generates such data today. In the intermediated CBDC model that the Federal Reserve would consider, intermediaries would address privacy concerns by leveraging existing tools,” the report said.

If this is indeed how the digital dollar is set up, it won’t be a perfect analog to the physical dollar. At least at the moment, it’s unclear whether there’s a way to transact without intermediaries, whereas I can give anyone cash without going through a KYC process. Digital dollar proponents will say that it should enable this sort of privacy.

And finally, as pointed out by my friend Michael McSweeney over at The Block, the report highlights existing private stablecoins, though it stops short of a detailed analysis on what role the Fed sees them playing in a world where the central bank has its own digital currency.

The report also mentions concerns about financial stability, a common one among regulators ever since this one social media giant announced plans to create a stablecoin.

Energy needs

Last week’s House Financial Services Committee on Energy and Commerce (Oversight and Investigations Subcommittee) hearing on crypto’s energy use was pretty interesting, to me at least. It started out with some basic questions and explanations (“Bitcoin does not equal blockchain”), not to mention several off-topic complaints, but evolved into an in-depth discussion, even a debate between some of the witnesses on how to measure things like crypto mining’s energy efficiency.

You can catch up on the hearing on our live blog, or read the wrap we published after the hearing ended.

The debate, between Cornell Tech Professor Ari Juels and BitFury CEO Brian Brooks, may have been the most interesting aspect for me. Brooks pointed out that crypto mining machines are becoming more energy efficient all the time, but Juels pointed to the energy used per number of transactions processed to argue that more efficient machines does not mean a more efficient network.

This debate might be key to how lawmakers approach crypto mining regulation, if there is any such rulemaking in this field.

One issue that was not discussed, but perhaps should have been, was the issue of waste from facilities powering crypto miners. Environment & Energy Publishing, an energy-focused news organization (that is a subsidiary of Politico), reported last week that the Environmental Protection Agency (EPA) rejected applications from Greenidge Generation and Sioux Energy Center (run by Ameren) to continue running coal ash ponds beyond their current federally-mandated deadlines.

Coal ash is a “toxic slurry” byproduct from coal power plants. The facilities dump this byproduct into what are basically open tanks. The risk of toxins from the ash leaching into the ground or nearby bodies of water is real, and so these facilities are regulated.

“EPA considered Greenidge disqualified from getting an exemption because it no longer uses coal for power. The agency said Ameren’s application for an extension lacked all the information required for deciding on its request,” EE News reported.

The power plants have a hair over four months to report to EPA they are no longer using their ponds.

This kind of action is worth keeping an eye on – it’s all very well to resurrect dead power plants to run crypto miners, but if these facilities can’t dump their waste they may not be able to continue operations for as long as their owners would like.

Biden’s rule

Changing of the guard

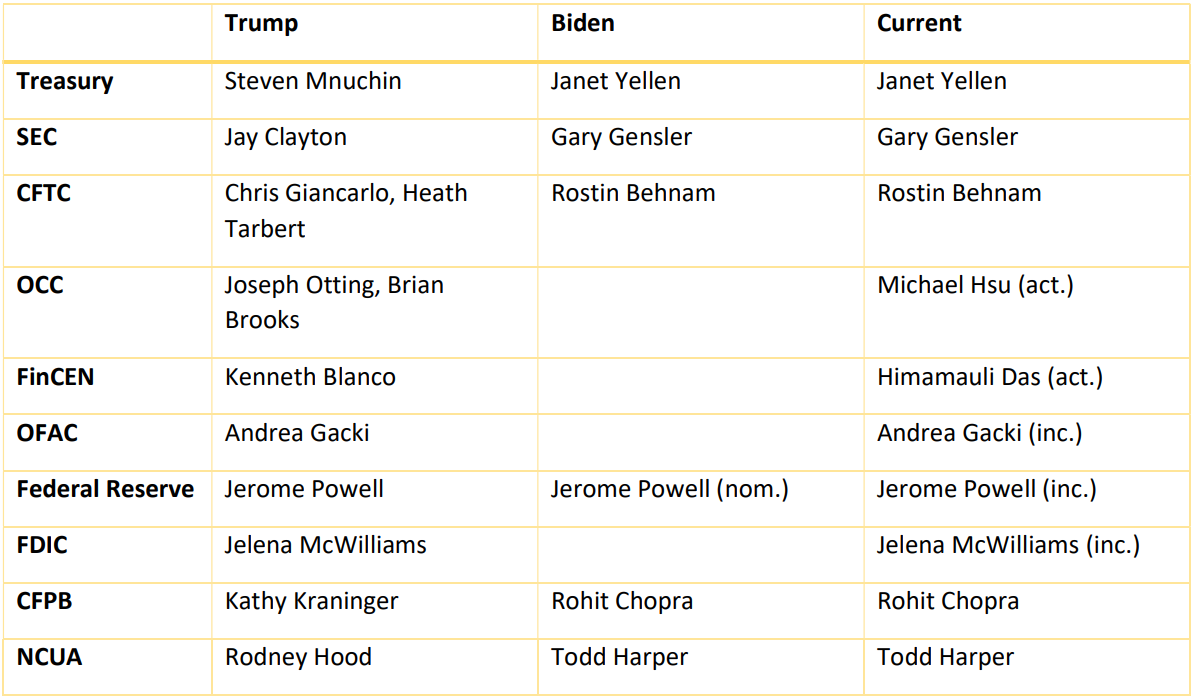

I think we’re now once again waiting to see who gets the nod to run the Office of the Comptroller of the Currency, not to mention the Federal Deposit Insurance Corporation.

Elsewhere:

- Biden Administration to Release Executive Order on Crypto as Early as February: Report: In October we learned the White House was looking to issue an executive order coordinating crypto regulatory efforts at the federal level among the non-independent departments. This seems to be less focused on issuing a specific rule and more about a general agenda, but at any rate, we might soon see it.

- Introducing CoinDesk’s Privacy Week: CoinDesk is taking on the international Data Privacy Week with features, explanations, opinion submissions and a host of other pieces looking at privacy concerns and how cryptocurrency networks address them. They’re well worth a read.

Outside CoinDesk:

- (Reuters) A long-form Reuters investigation by Angus Berwick and Tom Wilson revealed that crypto exchange Binance did not implement strong know-your-customer controls, and withheld information “about its finances and corporate structure from regulators,” despite what the exchange claimed in public. Reuters cited documents from Binance, correspondence between Binance employees and regulators, internal documents and interviews with former exchange employees and affiliates. Binance sent Reuters a statement but, according to the news agency, did not respond to detailed questions. Founder Changpeng Zhao has since tweeted “FUD,” continuing what appears to be an ongoing animosity toward journalism.

- (Reuters) Thomson Reuters Foundation News took a look at art theft and fraud in the NFT space. Avi Asher-Schapiro spoke to NFT artists and victims of theft in laying out what the concerns are. What stood out to me the most though was a stat from DeviantArt, which now scans for art turned into NFTs without the artists’ permission. “It has flagged more than 90,000 since it started scanning in September,” Asher-Schapiro wrote.

- (ScienceDirect) “Blockchain-based data transmission control for Tactical Data Link,” where TDL is a term referring to military communications links. Yeah I actually don’t even know where to begin with this one. Have at it folks.

underrated skill in computer science is how to break down problems into even bigger problems. how to snowball making a button slightly bigger into a 10 people 1 year project. how to create job security by being the subject expert in a problem you made up in the first place

— laura (@freezydorito) January 23, 2022

If you have thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!

[ad_2]

Source link