[ad_1]

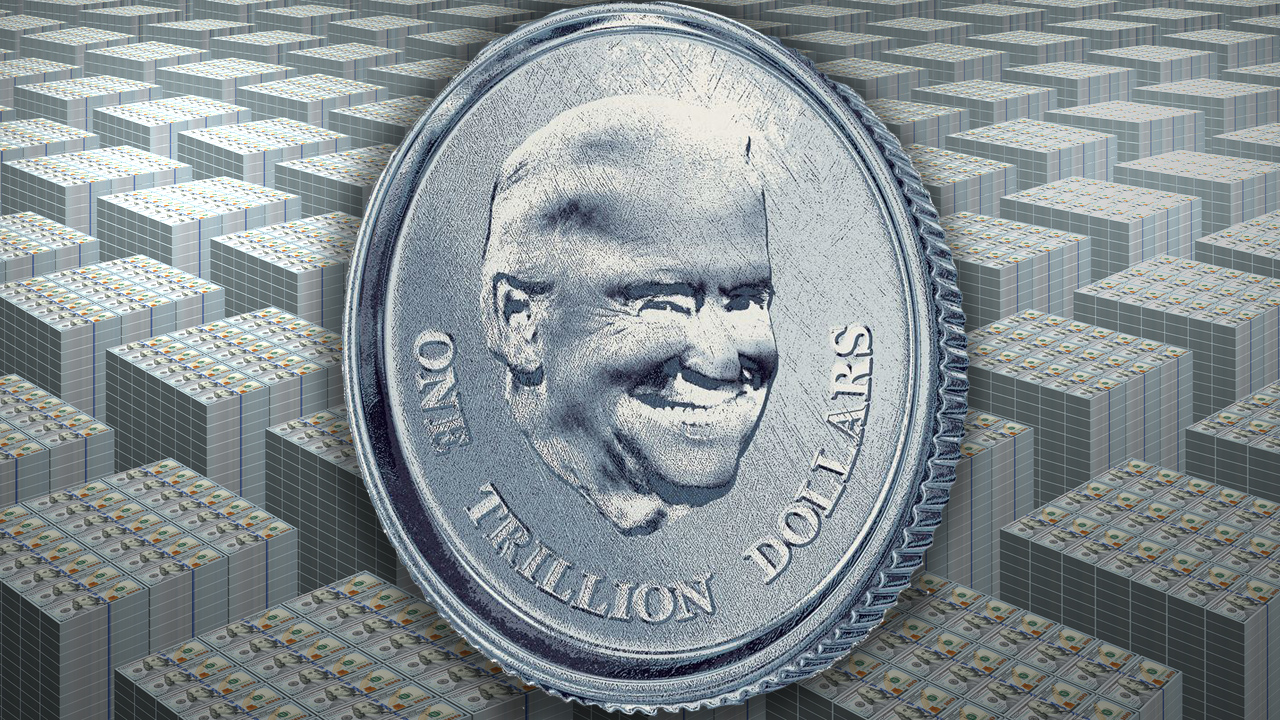

American politicians have been clamoring about the U.S. facing a significant debt crisis and the debt ceiling putting the country at risk of default. Joe Biden spoke about the debt ceiling and told Republicans to “just get out of the way” when it comes to the decision. Meanwhile, a number of U.S. bureaucrats are floating the idea of minting a $1 trillion platinum coin in order to magically bolster the treasury with cash.

Trillion-Dollar Coin Concept Strongly Considered by US Politicians, Former US Mint Director Says Platinum Coin Can Be Minted in Mere Hours

Simply creating new fiat out of thin air these days is an extremely popular trend, and it seems that many politicians worldwide have not considered the history of economies that have been destroyed by excessive monetary expansion. In the U.S., public officials have been discussing the country’s debt ceiling and whether or not America will default on what it owes.

Speaking at a White House news conference, U.S. president Joe Biden stressed: “Raising the debt limit comes down to paying what we already owe… not anything new.” Biden says that Republicans are stonewalling the need to raise the debt limit and he’s asked the party to simply “get out of the way so you don’t destroy [the country].”

Meanwhile, a number of public officials and mainstream media outlets are discussing the idea of minting a $1 trillion platinum coin to save the economy from disaster. It’s not a joke and it is being strongly considered by U.S. politicians who are fans of heterodox macroeconomic concepts like Modern Monetary Theory (MMT).

Moreover, thanks to an interesting piece of legislation, the executive branch — without congressional approval — can mint coinage of any denomination as long as the currency is made from platinum. Additionally, Axios reporter Felix Salmon explains that even if Janet Yellen doesn’t tell the public, she could “quietly instruct the Mint director to take those steps a day or two in advance.” Salmon added:

At that point, a coin could be struck in minutes at the West Point mint. Even if it then needed to be physically deposited at the New York Fed, that’s only a short helicopter ride away.

Yellen Calls the Coin Idea a ‘Gimmick,’ MMT Proponent Rohan Grey Says the ‘Debt Ceiling Itself Can Be Viewed as One Big, Poorly Designed Accounting Gimmick’

The unique law enabling the creation of such a coin was devised 20 years ago and intended to help bolster the production of commemorative coins. A financial debt crisis is not mentioned within the rules.

The law specifically states that Janet Yellen, the U.S. Treasury secretary can “mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the secretary, in the secretary’s discretion, may prescribe from time to time.”

While Yellen dismissed the idea on Tuesday alongside a group of Democrats, Philip Diehl, former director of the United States Mint, says the decision could still be made. The trillion-dollar platinum coin could be minted “within hours of the Treasury Secretary’s decision to do so,” Diehl remarked.

Yellen described the idea as a “gimmick” and told CNBC reporters that “what’s necessary is for Congress to show that the world can count on America paying its debt.” The CNBC report quotes MMT proponent Rohan Grey’s take on the matter who said “sure it is” a gimmick when referring to Yellen’s statements.

“The fact that (the coin) represents an accounting gimmick is a source of its strength, rather than a weakness,” Grey explains in a paper he wrote in the Kentucky Law Journal and shared with CNBC. “The idea of ‘fighting an accounting problem with an accounting solution’ is entirely coherent… the debt ceiling itself can be viewed as one big, poorly designed accounting gimmick.”

What do you think about the trillion-dollar platinum coin idea? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link