[ad_1]

Index tokens are a vital tool for making breakthroughs happen. By providing automated rebalancing and diversification of crypto portfolios, they represent both convenience and risk alleviation.

Index tokens bring asset automation and risk reduction to your yield farming ventures. As blockchain finance continues to evolve, they aim to streamline investment experience just as ETFs do in the traditional stock market.

What Are Index Tokens?

The GameStop short-squeeze drama is simmering down now, but it resulted in hedge funds losing billions of dollars and more people than ever entering high finance. For newcomers, this sector tends to be rather overwhelming as they have to wade through all the muddled jargon. In many ways, it is like learning a new language, the language of finance which gains in complexity as it is mimicked on the blockchain.

So before we explain index tokens in Decentralized Finance (DeFi), it’s worth retracing the roots of this concept back to traditional finance. Anyone who has used the Robinhood, eToro or Fidelity trading apps would have encountered ETFs – Exchange Traded Funds. Simply put, a ETF is an index-tracking fund that signifies the diversification of risk across your investment portfolio which contains a variety of stocks grouped by industry sector.

For the majority of retail investors, ETFs represent the first, low-risk step in market exposure, either in equities, commodities or the fixed income market. Unlike traditional index funds, ETFs are bought and sold in real-time on stock exchanges like the NASDAQ or NYSE. Given that this collection of stocks represent certain industry sectors, indexes allow us to evaluate how they perform on the stock market.

The most popular ETF – index fund – is the S&P 500, representing the companies with the largest market capitalization, from Amazon to Tesla. Therefore, with such enormous wealth accounting for about $30.5 trillion, the S&P 500 Index serves as an indicator for the health of the entire economy, as we saw when the stock market crashed in March last year.

S&P 500 INDEX. Photo: TradingView

With this in mind, we can see why an index plays an important role as an indicator of economic performance. Likewise, in the world of blockchain and tokens, index tokens comprise numerous tokens, which altogether provide us with investment insight into the cryptocurrency market, easing our trades and reducing risk in the process.

How Are Index Tokens Derived?

With so many tokens on the market varying wildly in price, index tokens are created by the weighted average of numerous tokens. This process has two steps:

- Selecting a representative sample of tokens or ‘sampling’, where each different token represents a certain niche. This is a standard technique used all the time in marketing and political polling.

- The next step is ‘weighting averages’, which is like classical mathematical averaging that calculates the mean (average) point of multiple data points. The difference is that in a ‘weighted’ average, some tokens contribute more to the average than other tokens.

Then we arrive at an index token with the following formula, used by the most popular crypto exchanges in the world such as Binance, Huobi, Jex and OKEx:

(P1*Q1+P2*Q2+P3*Q3+…+Pn*Qn)/(Q1+Q2+Q3+…)

(Q represents the weighted number and depends on the dominance of the token)

We can further divide index tokens into the decentralized and centralized kind, mirroring the stock market in the cryptocurrency space led by Huobi Index and OK06 Index. Binance JEX Index on the other hand provides a derivatives and futures overview. Of course, different indices use different methodologies to form an index token. For example, JEX Index uses the weight calculation method for circulation market value. Note that assets traded for 1 day in the exchanges will be selected for the sample assets pools that will participate in the circulation of the index, with some exceptions.

In contrast to this, decentralized indices are powered by Ethereum’s smart contracts where the entire process is automated. This mechanism for staking and token generating was not very popular in the initial stages of DeFi development because it required a high degree of user engagement:

- Sending tokens to the smart contract address which then generates index tokens that need to be sent to the stake-holder’s address.

- The stakeholder then sends the index tokens to a “burn address”. In turn, receiving staking tokens.

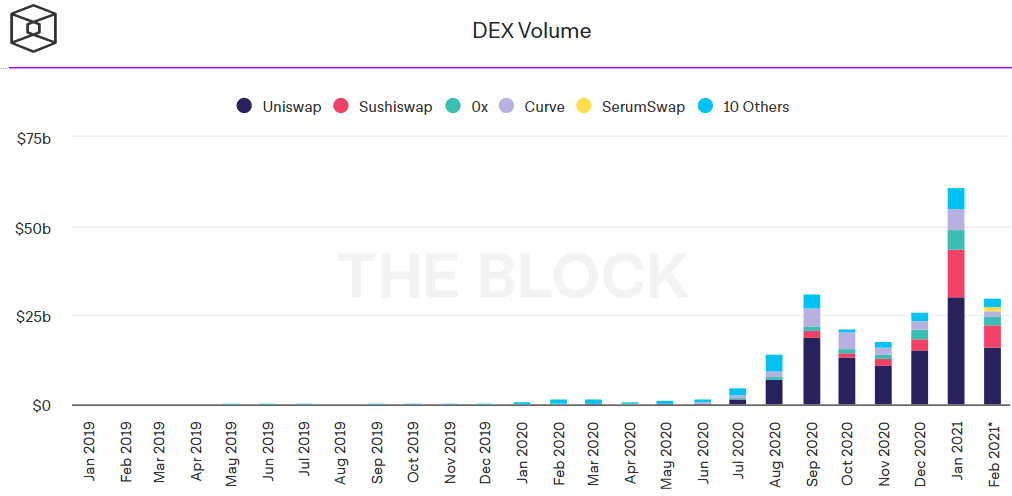

Given this level of tedium, large crypto exchanges have pioneered their own decentralized solutions, e.g. Binance with its Jex or Coinbase when it acquired Toshi, just to name a couple. At the end of 15 January 2021, decentralized exchanges (DEX) have accrued a record-high $60 billion in trading volume, according to The Block Crypto data.

Photo: The Block

Benefits of Index Tokens

To best understand the importance of index tokens, we just have to imagine what we would lack if they didn’t exist:

- We wouldn’t be able to see market trends in the crypto space or gauge the mood of other market participants.

- We wouldn’t be able to easily track DeFi tokens within specific market cap ranges.

- We wouldn’t be able to group them together and provide tokens with the opportunity to expand beyond their DeFi platform.

- We would lack having index tokens as a viable strategy for growth and funding for innovative DeFi projects.

Although the DeFi space surpassed the $40 billion milestone this February, some aspects of the ecosystem are still undeveloped, including index tokens. Nonetheless, healthy growth figures indicate that 2021 will be the year in which DeFi enters its maturity stage, just as Bitcoin entered it with last year’s institutional investment spree.

Top 3 Index Tokens

DeFi Pulse Index

This is the go-to site for a quick overview of all the happenings and latest rankings within the DeFi space. Not many people realize that DeFi Pulse also has its own eponymous index token.

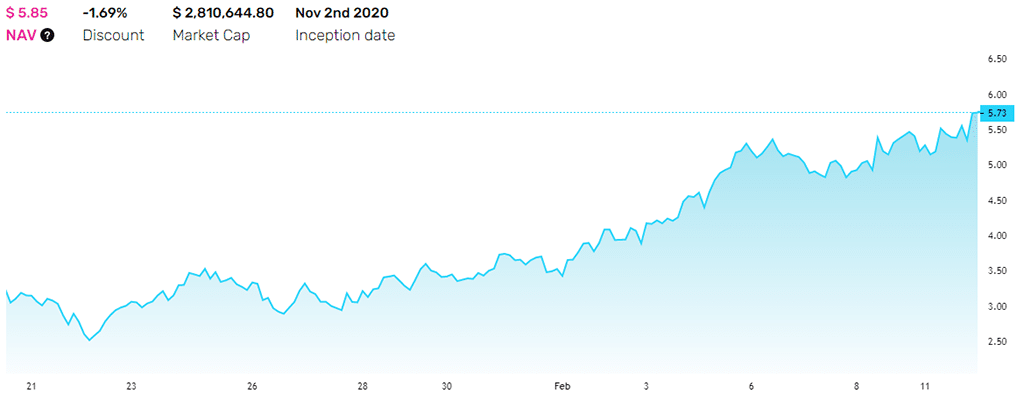

Photo: TokenSets

Created on 9 September 2020, DeFi Pulse Index currently holds 11 top tokens for the biggest DeFi borrowing and lending protocols, alongside DEXs: MKR, AAVE, SNX, UNI, YFI, COMP, REN, LRC, KNC, BAL, REP. Altogether, they have a market cap of about $130.9 billion.

SpaceSwap Index

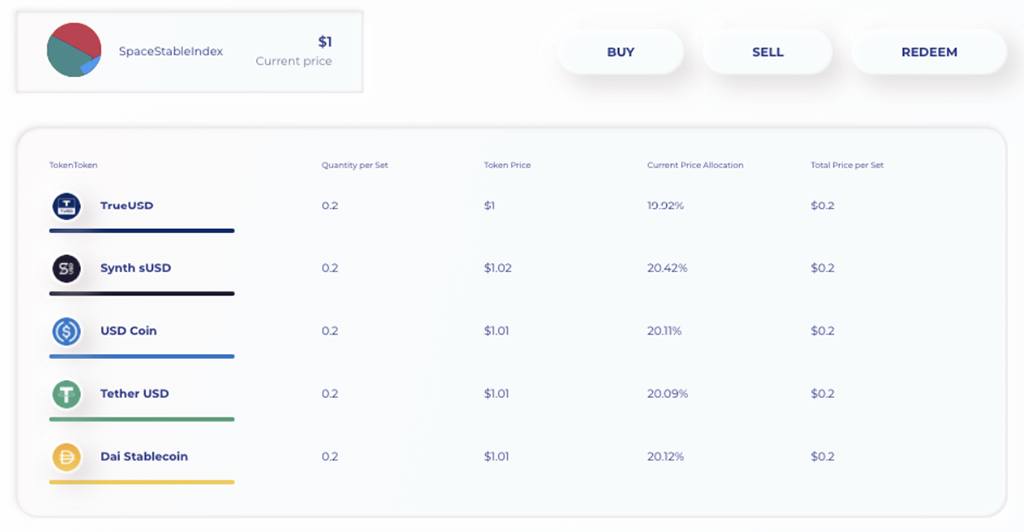

A relatively new and pleasantly themed DeFi innovator. SpaceSwap is continually creating an entire ecosystem within the broader DeFi ecosystem. Last year, the SpaceSwap team released the SpaceStableIndex and SpaceSwap Index protocol.

As the name implies, SpaceStableIndex (SSI) holds five stablecoins that serve as bridge for cryptocurrencies between various blockchains. More importantly, it provides peace of mind from knowing that its value is always anchored to the dollar instead of a notoriously volatile cryptocurrency. Being ERC-20, SSI takes advantage of Ethereum’s programmability, allowing users to automatically rebalance their stablecoin portfolio

PieDAO

PieDAO stems from a DAO (Decentralized Autonomous Organization) and supports the governance of institutions and businesses without using traditional hierarchical power structures. PieDAO represents the expansion of this concept into the decentralized market arena. It is governed by the DOUGH token.

It currently holds 13 tokens, with LINK and YFI making up a quarter of the stake. The PieDAO (DEFI++) Index has the widest range of assets. Its sibling index, DEFI+L, holds seven blue-chip DeFi tokens that regularly rank as top assets in market capitalization. More importantly, PieDAO gives you the ability to create a tokenized portfolio grouping for either crypto or tokenized traditional funds.

Takeaway on Index Tokens

It is a common refrain among blockchain enthusiasts that DeFi protocols are a revolutionary innovation. After all, anyone with internet access can take advantage of these virtual banks in a world where 1.7 billion people remain unbanked. Unfortunately, its intimidating complexity stands as a psychological barrier that needs to be broken.

Index tokens are a vital tool for making breakthroughs happen. By providing automated rebalancing and diversification of crypto portfolios, they represent both convenience and risk alleviation. Moreover, some DeFi projects like the SpaceStableIndex and Reserve, make use of stablecoins as the critical bridge to fiat currency. This makes it possible for people in undeveloped countries to safely store their hard-earned money without worrying about the hyper-inflation of their own failing fiat money.

next

Having obtained a diploma in Intercultural Communication, Julia continued her studies taking a Master’s degree in Economics and Management. Becoming captured by innovative technologies, Julia turned passionate about exploring emerging techs believing in their ability to transform all spheres of our life.

[ad_2]

Source link