[ad_1]

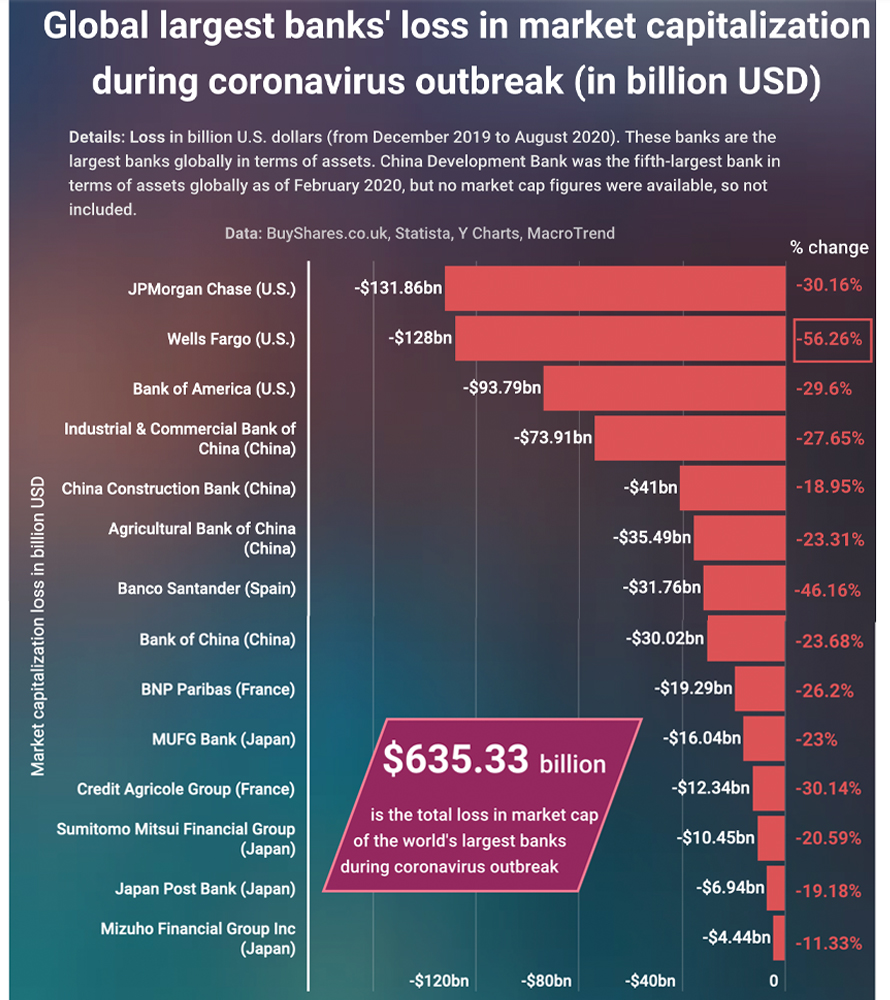

The world’s largest banks lost a considerable amount of market valuation amid the Covid-19 pandemic, according to a new report that estimates financial incumbents lost $635 billion. Between December 2019 and August 2020, the market caps of 14 major banking institutions lost upwards of 30-50% during the time period.

A newly published report written by Buyshares and the researcher Justinas Baltrusaitis, shows that during the first half of 2020, the world’s banks lost a considerable amount of market capitalization. Buyshares data shows that 14 select “major global banks” lost a combined total of $635.33 billion in market capitalization this year.

The biggest loser was Wells Fargo, which lost roughly -56.26% during the time period. Spain’s Banco Santander came in second place, losing -46.16% of its aggregate valuation.

Stats show that while Japan-based Mizuho Financial Group only lost 11%, the American bank, JP Morgan Chase saw a -30.16% drop in value in H1. The major losses from all 14 banks worldwide were significant drops, the Buyshares report highlights.

But researchers also stress that it “could have been much worse if there was no intervention from central banks.” Financial incumbents curbed disaster by receiving massive stimulus from the Federal Reserve. Additionally, the research says that regulators easing restrictions on liquidity, reserves, and capital “proved beneficial.”

Data shows that American banks took the largest hits, but JP Morgan Chase still has a decent market cap ($305.44 billion) today. Chinese banks followed American banks and both groups saw the biggest losses in February, as the start of the pandemic began to shake markets.

Meanwhile, the American banking cartel and the nation’s wealthiest 1% have been accused of fleecing $50 trillion from the bottom 99% during the last few decades. The accusation stems from a working paper written by Kathryn Edwards and Carter C. Price from the RAND Corporation called “Trends in Income.”

According to Price and Edwards calculations, during the course of four decades between 1975 through 2018, the estimate was around $47 trillion at the end of the year. The estimate crossed the $50 trillion zone in early 2020 and the disparity grew by $2.5 trillion per year.

The wealth disparity has stemmed from America’s political class (bureaucrats), a few generational demographics (statists), and the modern-day money changers (U.S. banks and the Fed).

Robert Kiyosaki, the author of the best-selling book “Rich Dad, Poor Dad,” recently tweeted about the wealth inequality and said crypto-assets like bitcoin will help younger generations improve the situation.

“Boomers had it easy,” Kiyosaki said. “Plenty of jobs-low cost real estate-rising stock market. Millennials have it hard. 9/11, 2008 real estate crash, [and] now Covid-19. Good news. Millennials [are] tech-savvy. Boomers [are] not. Bitcoin-block chain-digital currencies give millennials head start into the future.”

At press time, the market capitalization of all 7,600+ digital currencies is around $336 billion. The 14 banks that lost market cap saw losses close to 2x the size of the crypto economy. Still, JP Morgan Chase’s valuation is just a touch less than the crypto economy’s entire market capitalization.

Despite the banker’s losses, not many people on social media and forums (if any at all) are too concerned with the world’s megabanks after they have been given a lifeline of dollars from the Fed.

What do you think about the 14 banks losing $635 billion in market cap in 2020? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Buyshares data

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link