[ad_1]

On Sunday, March 7, 2021, the price per bitcoin jumped over the $50k handle once again, as the digital asset’s overall market capitalization is around $925 billion. One thing is for certain, there will never be more than 21 million bitcoin and today there’s roughly 18,647,525 bitcoin in circulation. Interestingly, anyone who owns 21 bitcoin or one-millionth of the entire supply is currently a millionaire today.

The ’21 Million Bitcoin Club’

Back in 2017, finance publications reported on a number of crypto proponents “gunning” for exclusive membership into the ’21 million club.’ The 21 million club refers to the number of bitcoins that will ever be produced and by the year 2140, that number will be 21 million BTC. During the last few years, many enthusiasts have tried to join the 21 million club by obtaining a single bitcoin, which is exchanging hands for a touch over $50k on Sunday morning.

For years now people can find a myriad of forum posts about people who have finally made it into the exclusive club of owners who hold a single bitcoin (BTC).

“After almost [two] years in crypto, I finally got in,” an individual wrote on Reddit two years ago. “It might be small for most of you here, but for a person in a third world country, this is a huge accomplishment. Now, to focus on my [altcoins], then sell them for BTC at the most opportune moment. Wish me luck,” he added.

Members of the 21 million club who own a single BTC, also own precisely 0.0000047619% of the entire supply per owner. Then there’s another club of bitcoiners who have obtained approximately 21 BTC or 0.0000999999% of the entire capped bitcoin supply.

Today one-millionth of the bitcoin supply is now worth over 1 million U.S. dollars. One-millionth of the bitcoin supply is approximately 21 bitcoin. This week, is another instance of this occasion, as BTC prices dropped in value a few days ago after reaching an all-time high (ATH) at $58,354 on February 21.

Ten days prior to the bitcoin (BTC) price ATH, crypto writer Pete Rizzo tweeted “One-millionth of the bitcoin supply is now worth $1 million.” At the time of publication, 132,325 addresses hold anywhere between 10-100 BTC, and owners of one-millionth of the bitcoin supply are represented among this aggregate of addresses.

Besides the enthusiasts that want to simply join the 21 million club by owning a single coin, there are many who have been obsessed with joining the club of owners who own a millionth of the BTC supply.

“The 21 BTC club becomes more difficult to join,” explains a web portal dubbed “21-btc.club.”

Why Did Satoshi Choose the 21 Million Supply Cap?

The reasoning behind why Satoshi Nakamoto chose the 21 million supply limit may have been done purposely for a number of reasons. According to an email between Mike Hearn and Nakamoto, however, the Bitcoin network inventor chose the 21 million limit number so it would align with the M1 money supply of fiat currencies like the euro and U.S. dollar. Back in 2008, the M1 money supply was approximately 21 trillion when Nakamoto published the white paper.

“I wanted to pick something that would make prices similar to existing currencies, but without knowing the future, that’s very hard. I ended up picking something in the middle,” Nakamoto said in the email to Hearn.

Satoshi Nakamoto added:

If Bitcoin remains a small niche, it’ll be worth less per unit than existing currencies. If you imagine it being used for some fraction of world commerce, then there’s only going to be 21 million coins for the whole world, so it would be worth much more per unit.

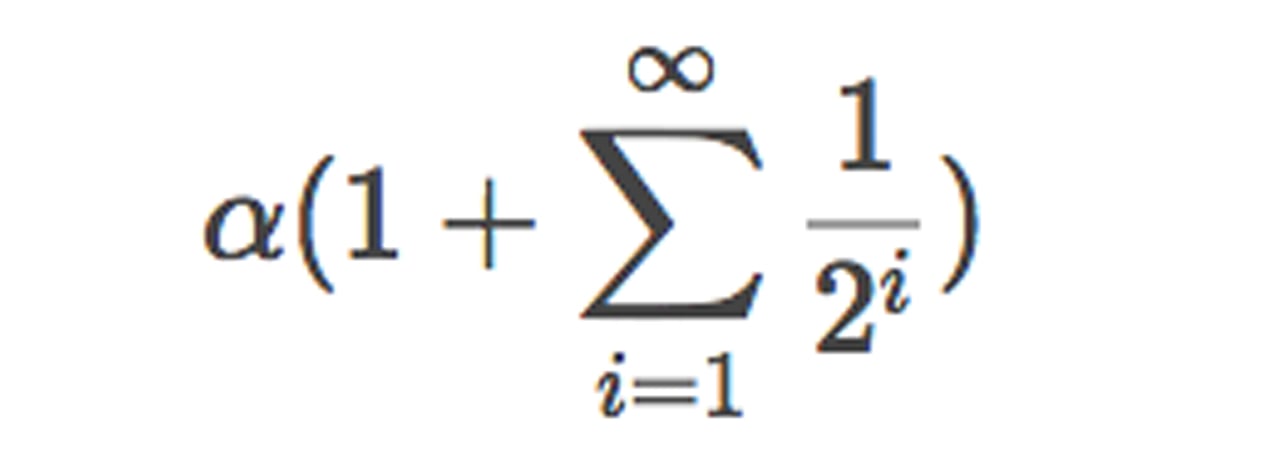

The white paper’s math also shows that the 21 million number further aligns perfectly with some of the interesting design patterns within the software. For instance, the 21 million number is integral to the block reward halving, alongside the 10-minute average time to mine a BTC block. Rewards are also cut in half every 210,000 blocks mined, and currently miners get 6.25 BTC per block.

Interestingly, the smallest unit in the Bitcoin network is a single satoshi or 0.00000001 BTC. The Ph.D., Christian Seberino explained in 2018, that Satoshi likely chose the 21 million in order to “involve floating-point arithmetic.”

Seberino says that even though BTC’s supply limit seems arbitrary, the reasoning behind why Satoshi chose the number is quite sound.

“It helps avoid errors on most computer systems, and is likely sufficient for all possible transactions everywhere,” Seberino emphasized. “Floating-point arithmetic is a type of mathematics used by computers to handle decimals. Decimals are often represented with 64 bits where one bit denotes the sign, 11 bits denote an exponent, and, 52 bits denote a fraction.”

The paper written by Seberino adds:

To avoid rounding errors, it is often a good idea to avoid integers that cannot be represented with only the fraction bits. To be extra safe, it may help to also leave one fraction bit unused. With respect to 64 bit decimals, that would limit integers to 51 bits. The maximum integer that can be represented with 51 bits is just slightly over 2100 trillion.

We honestly don’t have a solid answer to why Nakamoto chose the 21 million limit and he could have had insights into some numerological concepts we don’t know about. The 21 million clubs, whether it be holders of one single coin or 21 bitcoins total, will likely continue to grow over time and even change hands across generational wealth boundaries.

Furthermore, every time bitcoin (BTC) increases by $50k, then the holders of 21 BTC will see a wealth increase by another $1 million USD. Some would say it’s not too late to join the clubs, if they are interested in carrying wealth into the future.

What do you think about the 21 million bitcoin club and the reasons behind why Satoshi Nakamoto chose that number for the supply limit? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Cryptoart.com, Alix Branwyn, Christian Seberino,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link