[ad_1]

Computer chip manufacturer Intel Corp. has revealed it holds a stake in the leading U.S. cryptocurrency exchange, Coinbase. The tech giant purchased the shares worth almost $800,000 after the digital asset trading platform went public earlier this year.

Intel Acquires Shares of Crypto Exchange Coinbase

Intel has disclosed it owns Coinbase stock in a quarterly report submitted to the U.S. Securities and Exchanges Commission (SEC) on Friday. The Santa Clara, California-based technology company bought the stake following the listing of the cryptocurrency exchange this spring.

According to the filed Form 13F, Intel had 3,014 shares of the platform’s operator, Coinbase Global Inc., as of June 30, valued at over $760,000 at the time. On that date, Coinbase’s stock closed at $253.30 per share, Market Watch details.

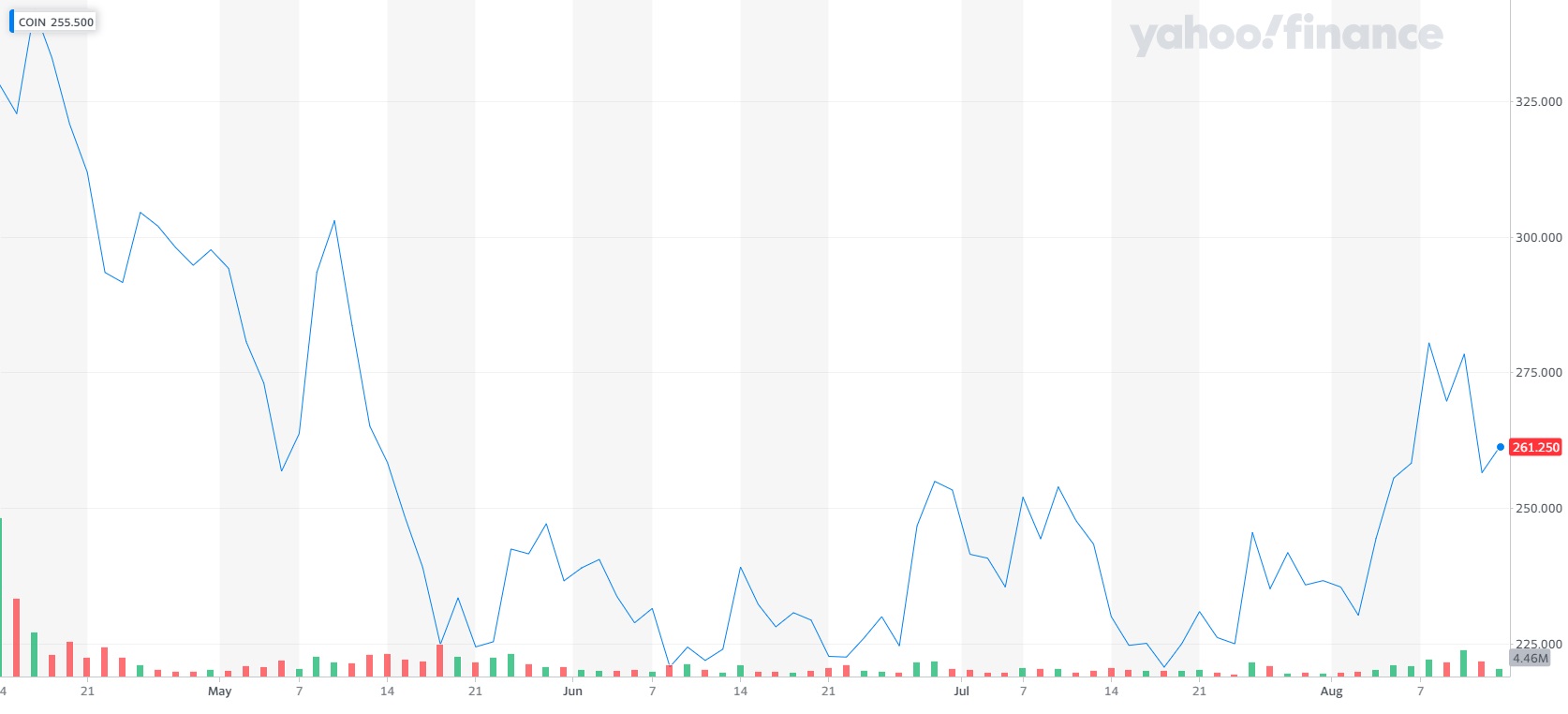

The price at the end of June was 22.8% lower than the $328.28 closing rate registered on the first day of trading of the COIN shares, April 14. The stocks have since recovered some of the lost value, recently exceeding $280.

On the last day before the weekend, Coinbase’s shares rose by 1.85% with a closing price of $261.25, Fox Business noted in its report on the regulatory filing. The shares of Intel remained almost unchanged on Friday, at around $53.50.

Earlier this week, Coinbase published earnings and growth data which showed the crypto trading company made over $2 billion in net revenue during Q2, 2021. The exchange also revealed it had around 68 million verified users while its retail monthly transacting users rose to 8.8 million, a 44% increase over this year’s first quarter.

The COIN shares acquisition isn’t Intel’s first foray into the crypto space. In April, the corporation joined forces with software giant Microsoft to deploy a threat detection tool designed to combat cryptojacking. And in 2018, Intel was granted a patent for a processing system capable of mining bitcoin in an energy efficient way.

What do you think about Intel’s investment in Coinbase shares? Tell us in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link