[ad_1]

The Indian government has revealed that 11 cryptocurrency exchanges have been under investigation by the country’s tax authority. About 95.86 crore rupees ($12.6 million) have been recovered from them.

11 Crypto Exchanges Investigated for Tax Evasion

The Indian government answered some questions regarding the taxation of cryptocurrency exchanges Monday in Lok Sabha, the lower house of parliament.

Parliament member S. Ramalingam asked the finance minister “whether it is true that some cryptocurrency exchanges were involved in evasion of goods and services tax (GST) and it was also detected that other cryptocurrency exchanges and major investors in digital currencies are under investigation by the government.”

In addition, the parliament member asked the finance minister about “the action taken or proposed to be taken by the government against those cryptocurrency exchanges that were detected in GST evasion.”

The minister of state in the ministry of finance, Pankaj Chaudhary, replied:

Few cases of evasion of goods and services tax (GST) by cryptocurrency exchanges have been detected by Central GST formations.

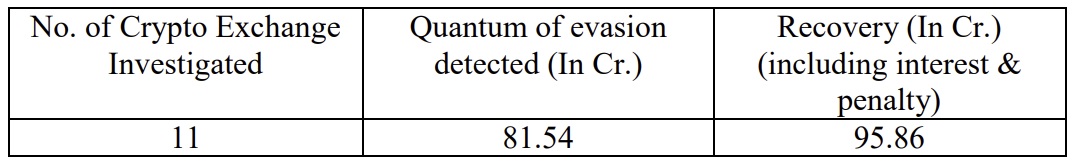

He revealed that 11 cryptocurrency exchanges were investigated and tax evasion in the amount of 81.54 crore rupees were detected. The tax authority has recovered 95.86 crore rupees, including interest and penalty.

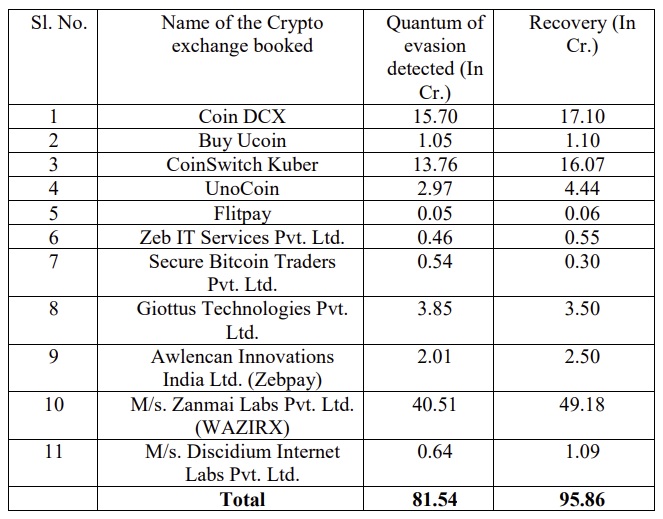

The minister of state provided a list of the 11 exchanges investigated: Coindcx, Buyucoin, Coinswitch Kuber, Unocoin, Flitpay, Zeb IT Services (Zebpay), Secure Bitcoin Traders, Giottus Technologies, Awlencan Innovations India, Wazirx, and Discidium Internet Labs. The exchanges with the most evasion detected were Wazirx, Coindcx, and Coinswitch Kuber, according to the list.

Lok Sabha member Ramalingam also asked the finance minister “whether the government has any data regarding the number of cryptocurrency exchanges that are presently involved in cryptocurrency exchange business in the country.”

Minister Chaudhary replied:

The government does not collect any data on cryptocurrency exchanges.

Meanwhile, Indian Finance Minister Nirmala Sitharaman has proposed taxing crypto income at 30% and imposing a 1% tax deducted at source (TDS) on every crypto transaction. A parliament member recently urged the government to reconsider imposing the 1% TDS, stressing that it will kill the crypto asset class.

What do you think about the minister of state’s answers? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link