[ad_1]

Data shows Ethereum staking has passed another milestone as more than 10% of the total ETH supply is now locked within the contract.

Around 12 Million ETH Is Now In The Ethereum 2.0 Deposit Contract

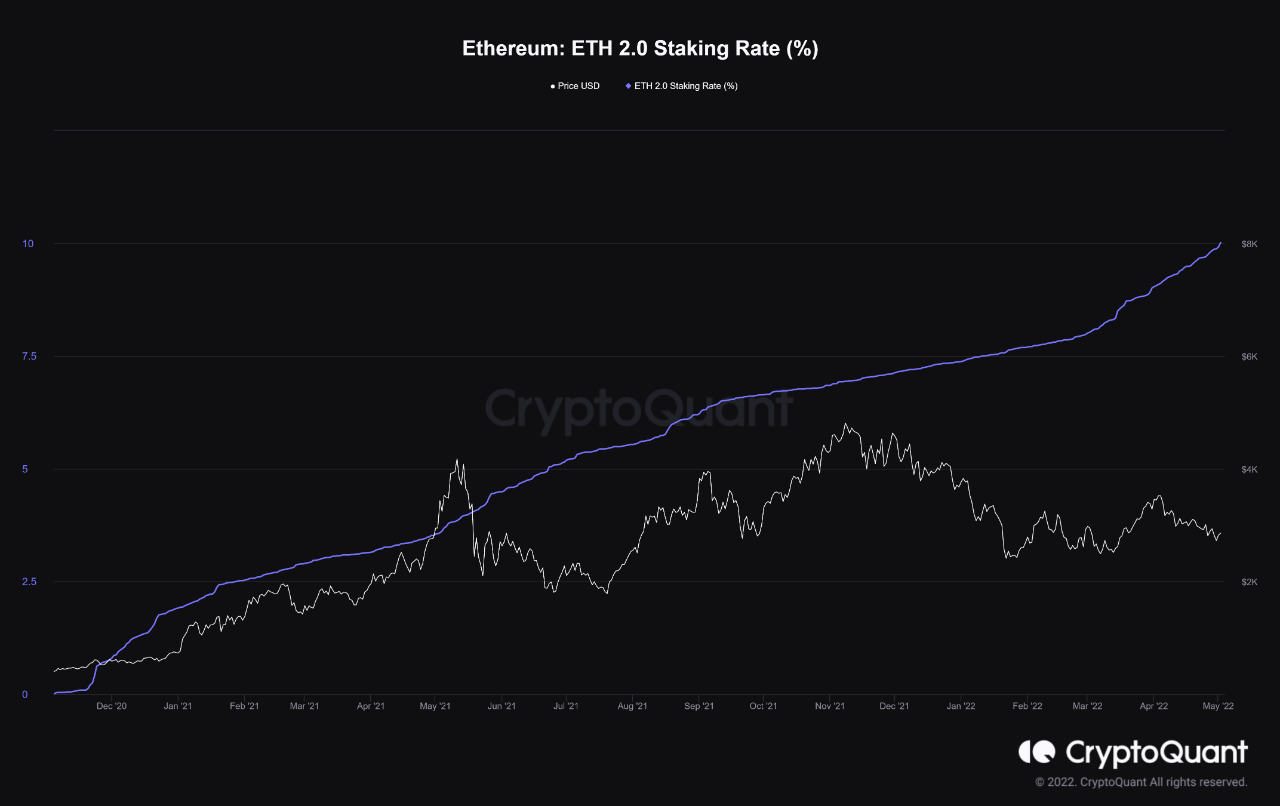

As pointed out by an analyst in a CryptoQuant post, the ETH staking rate has observed further surge recently, taking the metric’s value to 10% of the total supply.

In case anyone’s not aware of what “staking” is, it’s best to take a look at the “proof of stake” (PoS) consensus system first.

In cryptocurrencies using the PoS framework, network validators (called the stakers) need to lock in a minimum amount of the crypto into a contract (32 ETH in case of Ethereum) to participate in the consensus system.

The network then randomly chooses one of the stakers to sign the next transaction (stakers with the higher staked amount have a better chance of being chosen).

Related Reading | Bitcoin, Ethereum, Other Coins Now Supported By Argentina’s Biggest Private Bank

This is unlike proof of work (PoW), where miners require a high amount of computing power to compete with each other to sign the transactions.

Since mining machines can have a negative impact on the environment, PoW cryptos have increasingly come under scrutiny recently.

However, as PoS networks don’t require validators to have any high power hardware, they are by design more environmentally friendly.

The Ethereum “staking rate” is a measure of the percentage of the total ETH supply currently locked into its staking contract.

The below chart shows the trend in the indicator over the past couple of years:

Looks like the metric has observed sharper uptrend in recent months | Source: CryptoQuant

As you can see in the above graph, more than 10% of the total Ethereum supply is now locked into the staking contract.

Related Reading | EPA Vs. Bitcoin: Dorsey, Saylor, Others Oppose Lawmakers’ Call For Action Vs. Crypto Mining

More coins being locked into the contract can prove to be a bullish sign for the crypto as investors staking are usually in it for the long haul, and are thus unlikely to sell.

Ethereum Price

At the time of writing, ETH’s price floats around $2.8k, down 5% in the last seven days. Over the past month, the crypto has lost 17% in value.

The below chart shows the trend in the price of the crypto over the last five days.

The price of the crypto seems to have mostly moved sideways over the last few days | Source: ETHUSD on TradingView

Ethereum has been struggling for quite a while now, as has been the rest of the crypto and financial market. At the moment, it’s unclear when the coin may see any significant recovery.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link