[ad_1]

On Thursday, May 7th, the ETH rate resumes growth after a row of days “in the red”. Now Ethereum is generally trading at $207, having lost around 3% within the last 24 hours.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- ETH price forecast

- The Ethereum solving the scalability problem

- A blockchain must be efficient and flexible – Buterin

On W1, the Ethereum demonstrates a wave of mid-term growth after testing the area of the lows. The quotations are rising to the resistance line of the descending channel. The aim of the growth for ETH price becomes $260.00 USD. After it is reached, we should expect a declining wave to the lows of $89.80 and $80.86 USD. The possible decline is confirmed by the descending lines of the MACD and Stochastic. However, if the resistance line is broken away, the growth may continue to the levels of 23.6% ($398.00 USD) and 38.2% ($593.00 USD) Fibo of the previous declining wave.

Photo: Roboforex / TradingView

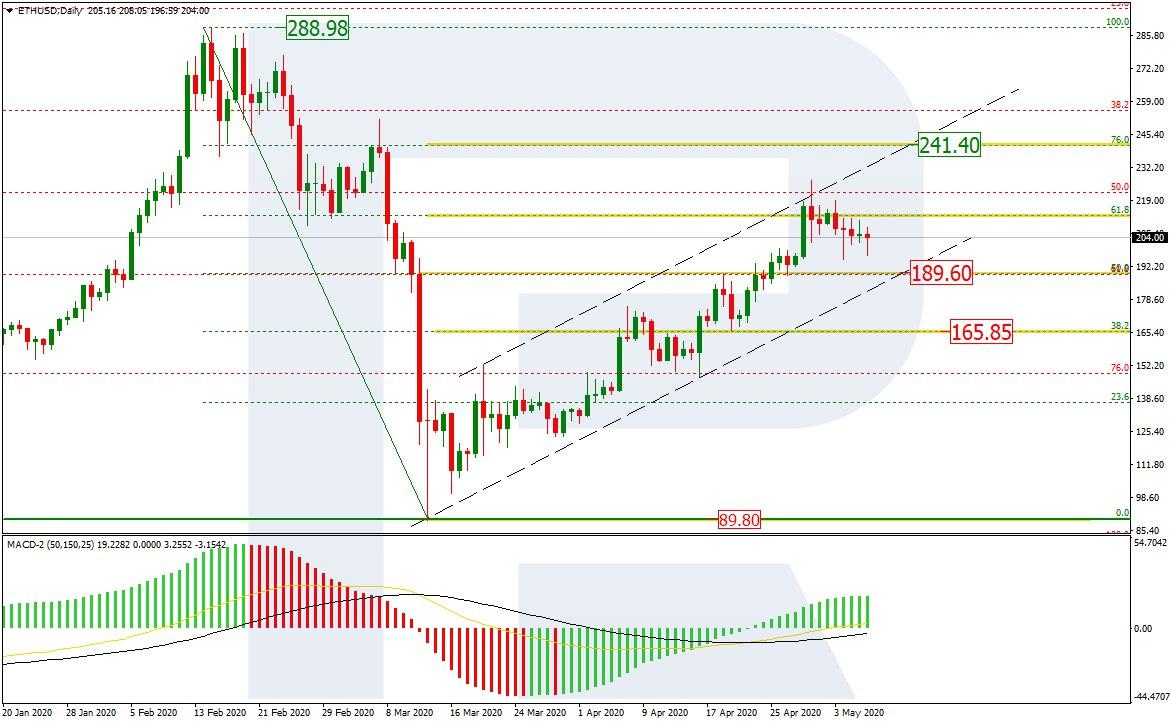

On D1, there is an ascending channel as a correction of the previous decline. The quotations have reached 61.8% Fibo and started pulling back to the support level of the current channel – the level of $189.60 USD. Breaking it away, the price will decline to $165.85 USD. After the pullback is over, the quotations will head for the next goal of the growth – the level of 76.0% ($241.40 USD). The MACD dynamics support the uptrend.

Photo: Roboforex / TradingView

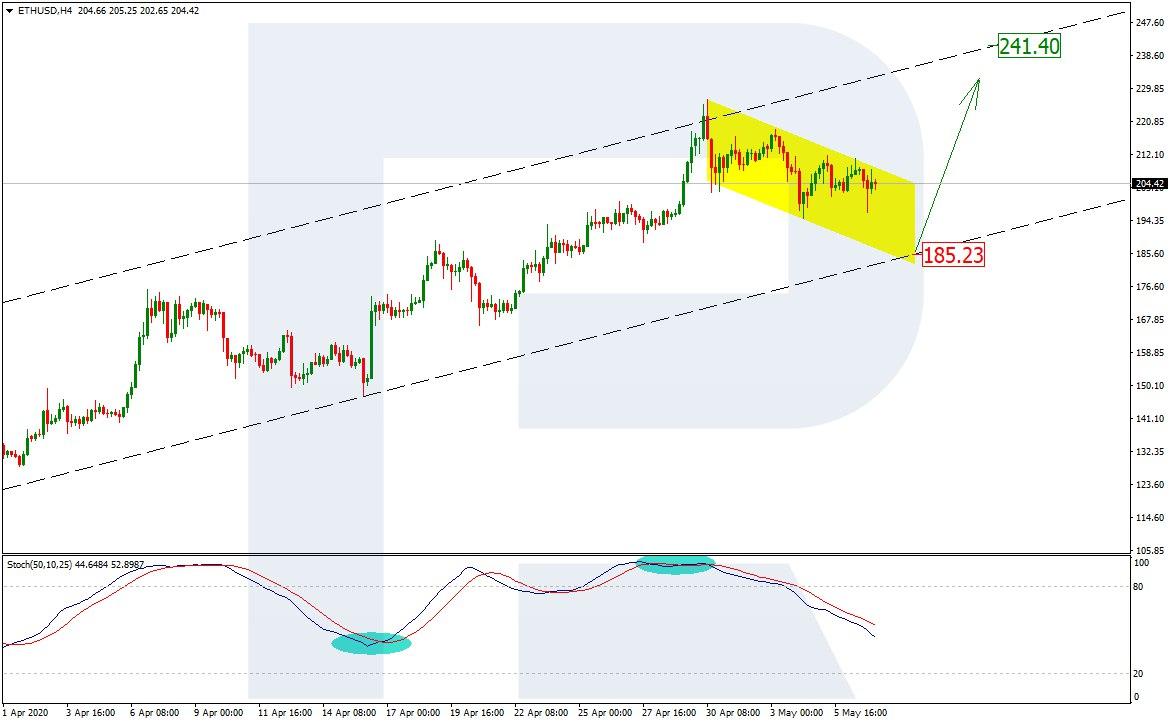

On H4, there is a local correction phase developing after a momentum of growth and reaching the resistance line. Another signal of the decline is a Black Cross in the overbought area of the Stochastic. The quotations are going down to $185.23 USD, after which they may rise to $241.40 USD.

Photo: Roboforex / TradingView

The Ethereum is coming closer to solving the problem of scalability. It has become known that the Synthetix demo protocol is ready for demonstration as a part of a trading contest with a prize fund. A derivative protocol Synthetix and researchers from the Optimism group united to test the advanced technology in the conditions close to real. At least, this is what they say in the Ethereum. As a part of this project, they also launch the Synthetix Exchange, which is a platform for issuing and trading synthetic assets. It will be based on the Optimistic Virtual Machine solution, which is the second step in solving the problem of scalability.

Why is it important? Solving this problem shortens the calculation chain, thus increasing the speed of all processes. The quicker one wins the race.

Also, they keep working on optimization in Ethereum. The company’s founder Vitalik Buterin in the document called “Resource pricing in a blockchain” says that the introduction of the protocol EIP 1559 will enhance the efficacy of money management for users. In the end, all discussions of the efficacy of a blockchain are reduced to maximizing user freedom in order to provide users with a safe platform for work.

The evolution of blockchain technology must be entering the phase when the more efficient and flexible one wins. Ethereum sticks to this way strictly.

Disclaimer: Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.

[ad_2]

Source link