[ad_1]

Top cryptocurrencies like Bitcoin and Ethereum may still be up by over 100% from the March lows, but it’s been a rocky past week for this nascent market.

Prices haven’t crashed per se, but cryptocurrencies have begun to print technical signs on their charts indicating that more downside is likely. One analyst recently remarked that since Ethereum closed below a key support level, it is somewhat vulnerable to a “larger correction” that the approximately 15% drop from the highs already seen.

Ethereum Prepares for Technical Breakdown

According to a prominent crypto trader, yesterday Ethereum lost a key level of support that has held four separate times over the past three weeks, adding to the chances that a “larger correction” is coming.

Chart of Ethereum’s recent price action from Credible Crypto (@CredibleCrypto on Twitter). The chart shows that the leading cryptocurrency recently lost a level of support that has held four separate times over the past three weeks, not boding well for the bull case.

Adding to the loss of a support level, multiple analysts expect all altcoins to underperform Bitcoin.

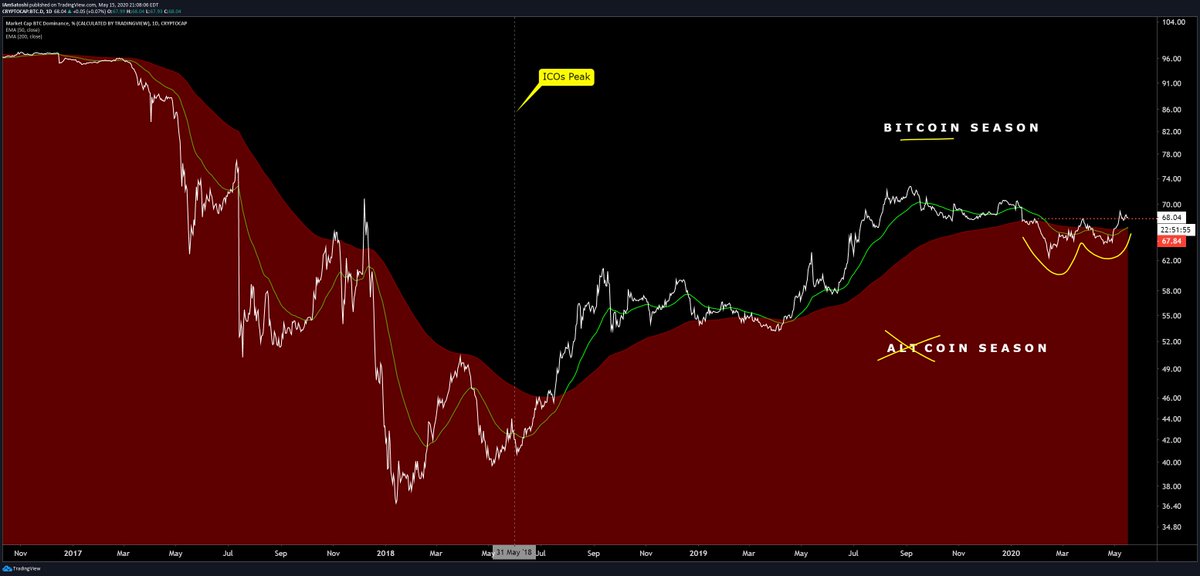

Per previous reports from Bitcoinist, Josh Olszewicz, a crypto analyst at Brave New Coin, observed on May 15th that Bitcoin’s dominance chart printed a textbook signal of strength: a golden cross.

The arrival of the golden cross, the analyst postulated, is a sign that those awaiting an “altcoin season” may be rudely awakened. Previous golden crosses on Bitcoin’s dominance chart preceded massive rallies in Bitcoin against altcoins, suggesting the same is likely to happen again.

Chart from Josh Olszewicz (@CarpeNoctum on Twitter), a crypto analyst at Brave New Coin. The chart is of Bitcoin’s dominance printing a “golden cross” formation.

Bitcoin Rally Could Negate Bear Trend

While Ethereum may be preparing to see a “larger correction,” a rally in the Bitcoin price could negate such a trend as altcoins follow the market leader.

Fortunately for ETH holders, analysts say that Bitcoin’s technical outlook is stronger than that of all altcoins.

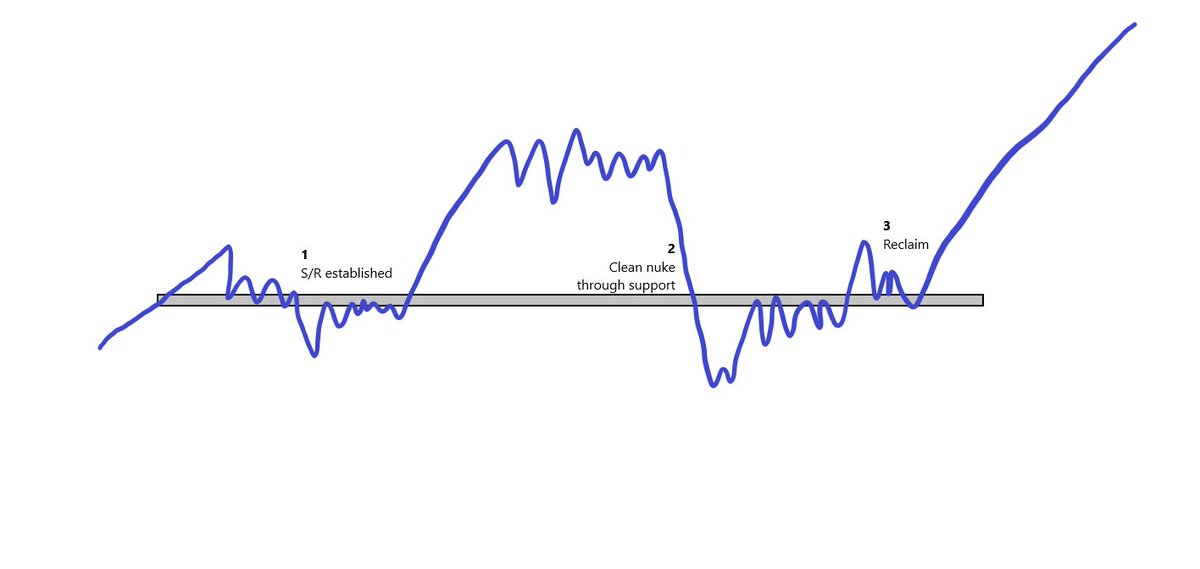

Mohit Sorout — a partner at crypto hedge fund Bitazu Capital — recently shared the schematic seen below, indicating that Bitcoin “loves to paint” this price action.

Chart from Mohit Sorout — a partner at crypto hedge fund Bitazu Capital. The chart shows a common pattern on Bitcoin’s chart that has historically preceded upside.

Featured Image from Unsplash

[ad_2]

Source link