[ad_1]

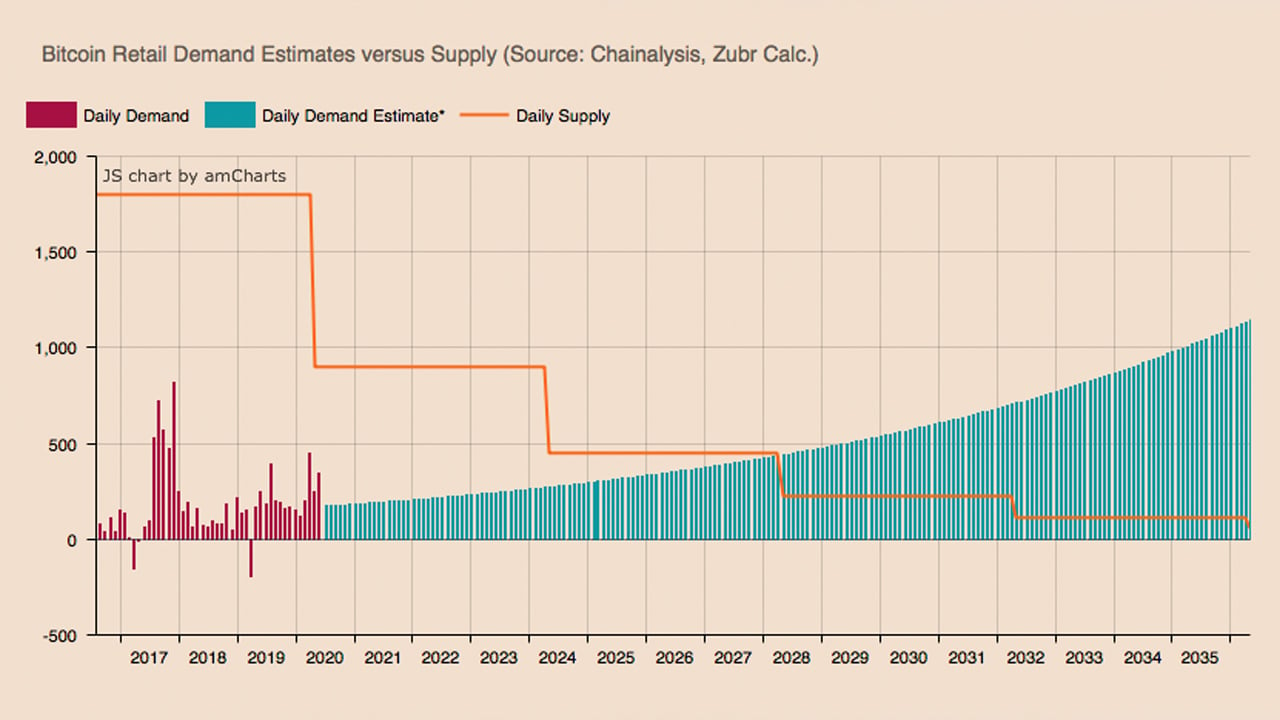

A recent report from ZUBR Research explains that by 2028, retail demand for bitcoin will exceed the supply. The report highlights that in eight years as Bitcoin’s supply rate decreases “retail size addresses [will] begin to eat up all the new supply alone.” Even the next halving in 2024 could see retail accounting for acquiring 50% of the bitcoins in circulation.

Not too long ago, cryptocurrency proponents witnessed the Bitcoin (BTC) network’s third halving which cut the block reward by 50% on May 11, 2020. Just before the third BTC halving, the active supply issuance or inflation rate was around 3.8%.

Today that number is steadily dropping and at the time of publication, BTC’s inflation rate is 3.51%. On June 29, a research report published by ZUBR Research details that in eight years, retail demand will outshine the rate of issuance by a long shot.

The study called “Retail Investors Steady in Physical Bitcoin Snatch-Up” explains how the BTC network has entered the “next reward era.” “With 90% of all Bitcoins already mined, the remaining supply is estimated to take nearly 120 years to come to market,” ZUBR wrote. “This figure – the remaining 10% taking another 120 years – shows just how scarce the cryptocurrency already.”

In time one of the great burdens will be liquidity and “physical Bitcoins become harder to come by.” The researcher’s findings also indicate that Covid-19 gave crypto proponents a glimpse at some potential scenarios. ZUBR Research also discussed the question of whether Bitcoin is a better version of gold or not.

The study says that investors will have to weigh this decision as “demand has moved in decline for gold further extending that gap available on the market” during the Covid-19 crisis. “No doubt, Bitcoin saw strong demand in the wake of the coronavirus pandemic. The demand was similarly witnessed for gold,” the report highlights.

ZUBR researchers add:

There is a very critical difference to gold, however. Bitcoin supply constraints will not be a result caused by black swan events (such as the global COVID-19 lockdown that shut-in mines), but the permanent perpetual nature of the store-of-value cryptocurrency that is designed to cut off new supply.

The study notes that the researchers leveraged data from the analytics firm Chainalysis. ZUBR predicts that retail demand will continue to grow this year and by 2028 the demand will be far greater than issuance.

Just like with gold markets, the demand for bitcoin while remaining scarce could send the price of BTC sky high. The next halving will sill a lot of retail and investor demand but the fifth halving will be uncontrollable buying pressure.

“Extrapolating future demand at this pace points to a very dramatic shift in 2028 when Bitcoin’s supply rate further decreases and these retail size addresses begin to eat up all the new supply alone,” ZUBR estimates. “By the time the next reward era comes around in 2024, retail could potentially account for eating up over 50% of the physical supply,” the researchers added.

The paper concludes by stressing:

With retail [investors] gunning hard, these supply constraints might come sooner rather than later should growth in demand from smaller investors remain as steady as it has in the past half-decade.

What do you think about the theory that retail demand will outshine bitcoin issuance in eight years? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, ZUBR Research

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer

[ad_2]

Source link