[ad_1]

Gabriel Makhlouf, the governor of the Central Bank of Ireland (CBI), has published a blog post in which he shares his views on the digitalization of finance. While echoing concerns expressed by his counterparts regarding cryptocurrencies, the official has also highlighted some of their positives.

Don’t Ignore the Positive Elements of Crypto Technology, Central Bank Governor Says

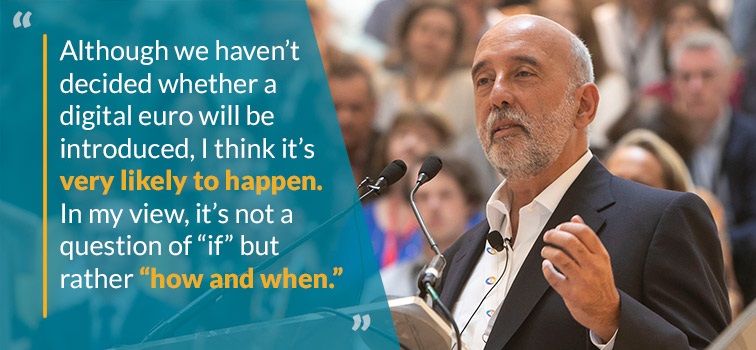

The article titled “Digital Money” was published on the bank’s website on Thursday. In the post, Gabriel Makhlouf discusses the project to issue a digital version of the common European currency. The European Central Bank (ECB) recently launched its “Investigation Phase” and although a final decision is yet to be taken, the governor believes that it is not a question of “if” but rather “how and when” a digital euro will be introduced.

Besides central bank digital currencies (CBDCs), Makhlouf devotes attention to the rise of decentralized money as a factor in the increasing digitalization of finance. Avoiding the “misleading descriptor” “crypto-currencies” and the “less inaccurate” “crypto-assets,” the banker refers to coins, stablecoins, and tokens simply as “crypto.”

“Risks are increasing as individuals consider putting some of their money into crypto,” Gabriel Makhlouf says, listing the lack of transparency, price volatility, high energy consumption, and exposure to fraud among the threats investors and governments are facing. “As things stand today, the negatives surrounding crypto far outweigh any benefits,” the Irish official concludes. However, he also insists that authorities should not ignore the positive elements of cryptocurrency’s underlying technology. The CBI governor notes:

Distributed Ledger Technology (DLT) is essentially a secure, decentralised record of information stored across a network and is a key piece of architecture for some types of crypto.

Makhlouf emphasizes that DLT can reduce the costs of financial transactions and eliminate intermediaries in certain cases while also praising the opportunity to issue smart contracts. “The use of DLT has increased in recent years – it certainly has potential – although it remains to be seen how widespread that will be,” the governor adds.

The importance of DLT is likely to increase as governments around the world examine options to employ blockchain technology in the design of their digital currencies. A recently conducted experiment with the participation of several central banks from the Eurozone and the ECB has indicated that a blockchain-based digital euro would be highly scalable. The tested CBDC system was able to simultaneously process over 300,000 transactions a second, the central bank of Estonia revealed earlier this week.

Do you expect most central bank digital currencies to be based on digital ledger technologies? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link