[ad_1]

The bitcoin marketplace Localbitcoins was once the most popular peer-to-peer (P2P) trading platform. But during the last few years, the company’s trading requirements and KYC implementation have caused an influx of traders to migrate to different P2P crypto markets. The mass departure has caused business on Localbitcoins to drop like a rock and volumes haven’t been this low since 2017. Additionally, alternative P2P trading platforms like Paxful are being criticized for their restrictions against certain countries.

Also read: Traders Bemoan New Localbitcoins Identity Requirements

The Aftermath of Localbitcoins’ Recently Implemented KYC and Trading Restrictions

The P2P marketplace Localbitcoins.com is a business headquartered in Helsinki, Finland and it has provided an over-the-counter (OTC) trading platform since 2012. Localbitcoins quickly became a popular avenue to acquire bitcoins because it allowed users to post offers on the website and it provided people with an avenue to trade in a P2P fashion, without much third party interference. In the early days, there was very little know-your-customer (KYC) requirements and trading restrictions.

Back then, you could trade as much as you wanted and didn’t have to verify your identity on the Localbitcoins platform. These days it’s an entirely different story and Localbitcoins has been criticized on multiple occasions for enforcing strict KYC practices and adding trading restrictions. Traders now have to identify themselves if they want to trade a significant number of bitcoins by submitting a photo ID.

In May 2019, residents from Iran were banned from trading on the Localbitcoins platform. When an Iranian visitor attempts to visit Localbitcoins.com there’s a geo-restriction message that says: “Unfortunately Localbitcoins is currently not available in your selected region – Please look for another location or come back later.” Not too long after the Iran restriction, on June 1st crypto enthusiasts were surprised to hear that Localbitcoins ceased offering in-person cash trades. By September 2019, Localbitcoins enforced new know-your-customer requirements and announced a partnership with the online ID verification company Onfido.

Localbitcoins then created a tier system for certain types of traders who trade either small amounts of crypto or very large numbers of bitcoin. Depending on the amount traded, a Localbitcoins user must submit specific ID requirements in order to continue using the service. Say you trade less than $1,109 per year then you would need to provide the firm with a phone number, full name, country of residence, and valid email address. Anything beyond the $1,109 per year threshold will have to submit ID to Onfido and a person who trades $22K per year needs to submit even more ID verification data. After Localbitcoins implemented the new rules and removed in-person cash trades, crypto enthusiasts noticed P2P markets like Bisq exchange and Paxful gathering more trade volume. Another issue people had with the service is when privacy advocates witnessed a banner on Localbitcoins.com that said: “Warning to all Tor users: A Tor browser exposes you to the risk of having your bitcoins stolen.”

Localbitcoins has really lost the plot pic.twitter.com/tNxtbLEr3t

— Richard Bensberg’); DROP TABLE USERS; — (@richardbensberg) September 9, 2019

Weekly Localbitcoins Volumes Slide to Pre-Bull Run Levels, Paxful User Banned for Checking His Account Status in Iran

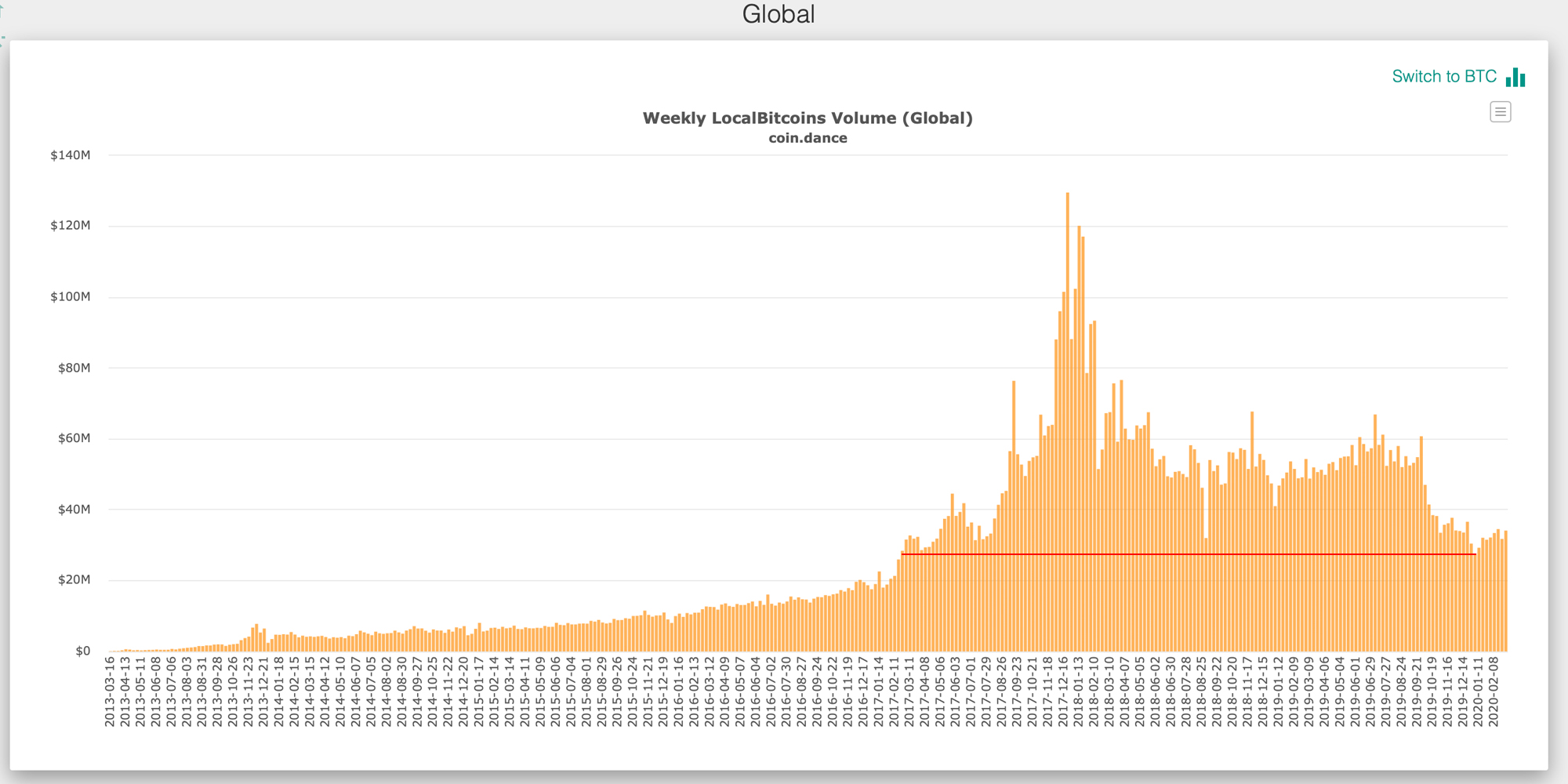

Since September, alternatives like Paxful, Bisq, Local.Bitcoin.com, and Mycrypto.com have seen more volume because of Localbitcoins’ new requirements. Data stemming from the website Coin.Dance shows Localbitcoins weekly volumes at the end of January 2020 matched the trade volumes recorded in March 2017.

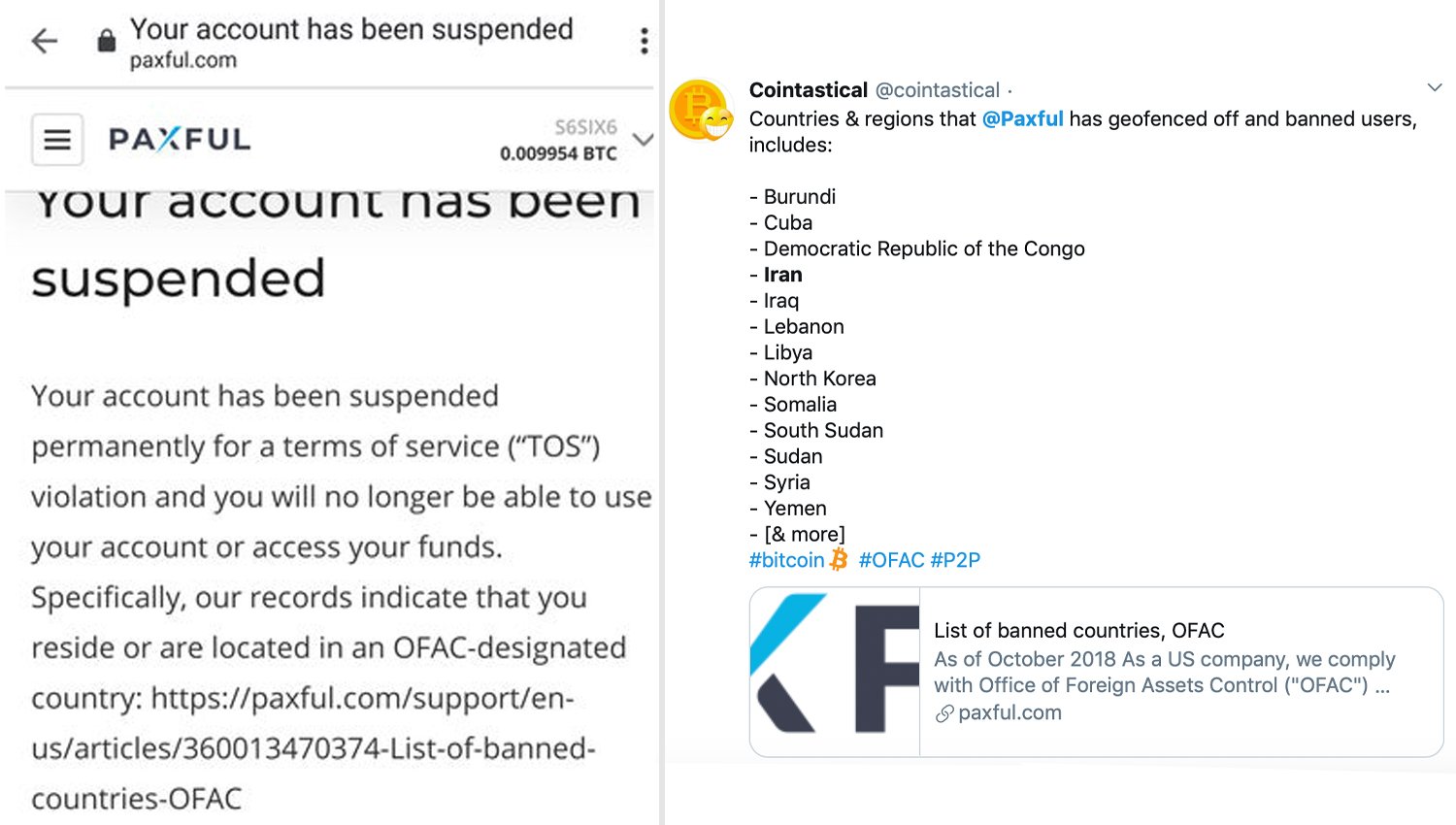

The OTC marketplace’s trade volumes are almost as low as those the site saw prior to the 2017 bull run and it all seems to stem from the latest platform changes. Another incident from a Paxful customer shows on March 5, 2020, a user complained about checking his Paxful account while traveling to Iran and claimed his account was frozen thereafter. The problem arose while he was in Iran as he says he simply looked at his account but performed no transactions or made no transfers during the checkup.

A screenshot of an email allegedly from Paxful says that his account was “permanently suspended” because the customer was allegedly located in an “OFAC-designated country.” The email does have a link that leads to Paxful’s rules against OFAC countries like Iran and North Korea. A few commentators on the Reddit forum r/bitcoin told the Paxful customer that he should have just followed the rules.

“I didn’t do anything illegal – what’s wrong with logging in to your account and checking daily updates,” the Paxful user replied.

Bitcoin Cash Marketplace Local.Bitcoin.com Has Several Advantages

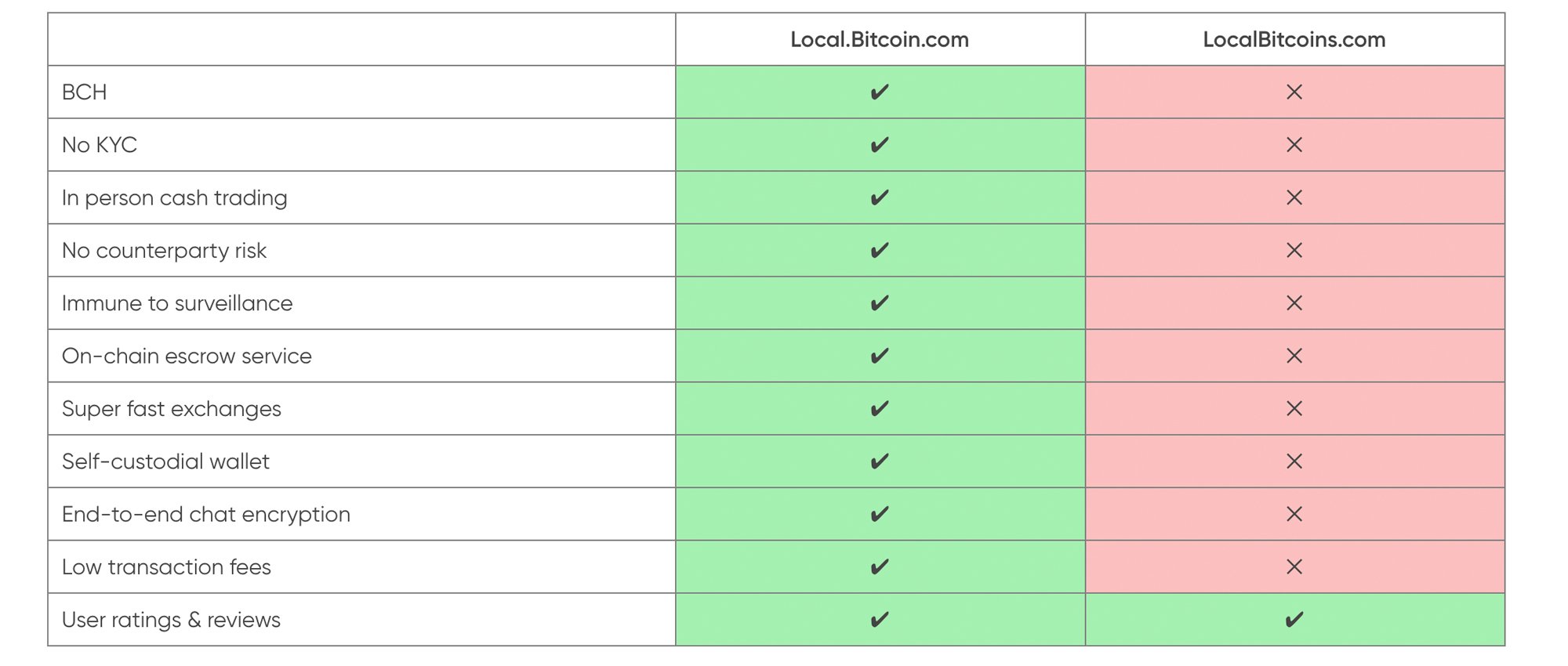

The Bitcoin Cash Marketplace local.Bitcoin.com has seen a stream of newcomers during the latter half of 2019 and into 2020. Local.Bitcoin.com is a noncustodial, private BCH trading platform that allows users to buy and sell bitcoin cash (BCH) anonymously.

Since launching in June 2019, the Bitcoin Cash marketplace has attracted well over 100,000 users. Traders come from all around the world to swap BCH in a noncustodial and secure manner. Our Bitcoin Cash Marketplace uses a blind escrow system (or escrow script) to bolster the platform’s security while people trade.

When the seller puts BCH in escrow, they are creating an onchain bitcoin cash transaction. The transaction has two outputs – the escrow output, which can be spent by the buyer or seller, and the fee output, that can be leveraged in an unsuccessful trade. For instance, if the trade is unsuccessful, the fee can be reclaimed by the seller.

Local.Bitcoin.com doesn’t have a tier system or geo-restrictions as trading from any country and across any borders is welcome just like cryptocurrency should be. Not only that but our Bitcoin Cash marketplace traders can feel comfortable making trades with others utilizing the service’s encrypted chat system. When you use local.Bitcoin.com you can count on end-to-end message encryption, messaging forward secrecy, financial forward secrecy, and a secure signature system.

Our team believes local.Bitcoin.com offers benefits that no other P2P crypto platform can provide like quick access to bitcoin cash (BCH), no KYC requirements, no surveillance, a self-custodial wallet, end-to-end chat encryption, low transaction fees, a rating system with reviews, and in-person cash trading is encouraged. A quick glance at the marketplace offers indicates that a number of local.Bitcoin.com traders trade locally.

What do you think about platforms like Localbitcoins.com seeing lackluster trade volumes due to KYC and trading requirements? What do you think about alternative OTC and P2P crypto trading platforms? What do you think about what the bitcoin cash marketplace local.Bitcoin.com? Let us know what you think about this topic in the comments section below.

Image credits: Shutterstock, Reddit, Twitter, Fair Use, Local.Bitcoin.com, Paxful, Coin.Dance,

[ad_2]

Source link