[ad_1]

On Thursday, April 2nd, the BTC is growing, trading at $6,715. The numbers look symbolic, but in reality, it means little: the cryptocurrency is failing to develop the current impulse effectively.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Bitcoin price is climbing now

- In three weeks, the BTC grew by 76%

- The monetary policy of the Fed will support the BTC

On W1, the Bitcoin keeps demonstrating a significant pullback after a fast decline but slows down a bit. The general market mood is declining, and the nearest goal of the main trend is the fractal low of $3121.90 USD. The resistance is at $8500.00 USD. The dynamics of the MACD and Stochastic lines confirm further declining.

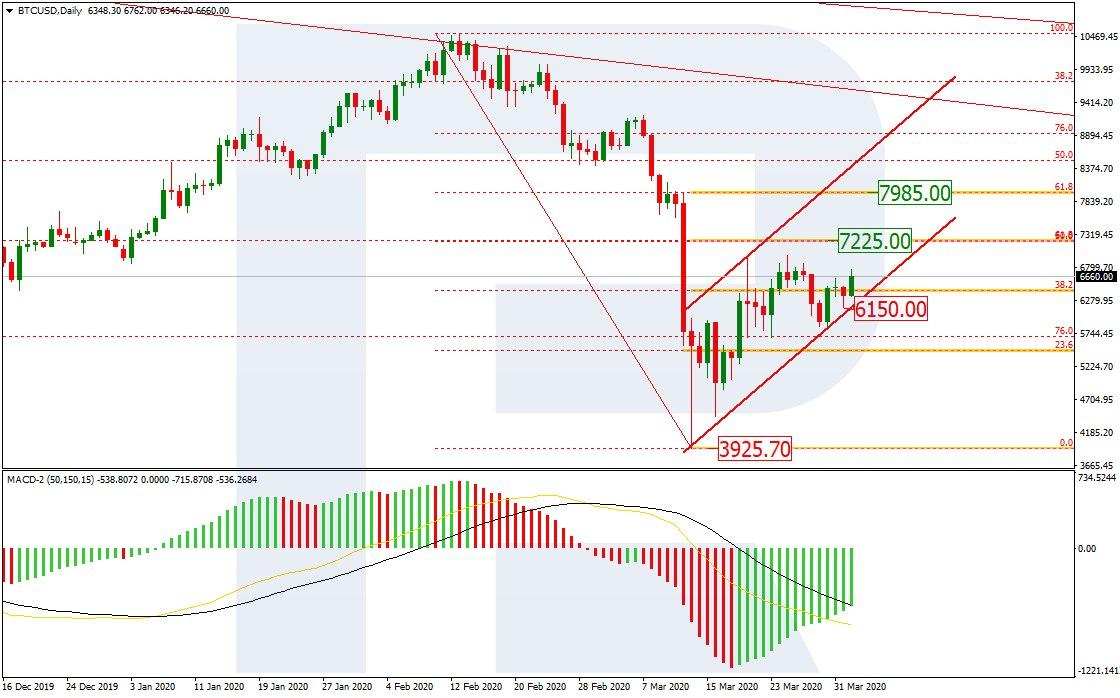

Photo: Roboforex / TradingView

On D1, BTC/USD shows a small change in the structure of the ascending channel after a short-term pullback. A test of the resistance line and a subsequent bounce will allow the market to form an impulse of growth to the Fibo levels of 50.5% ($7225.00 USD) and 61.8% ($7985.00 USD). A breakaway of the current support level at $6150.00 USD will signal a decline to the low of $3925.70 USD; the potential decline is also confirmed by the declining MACD lines, that are below zero as well.

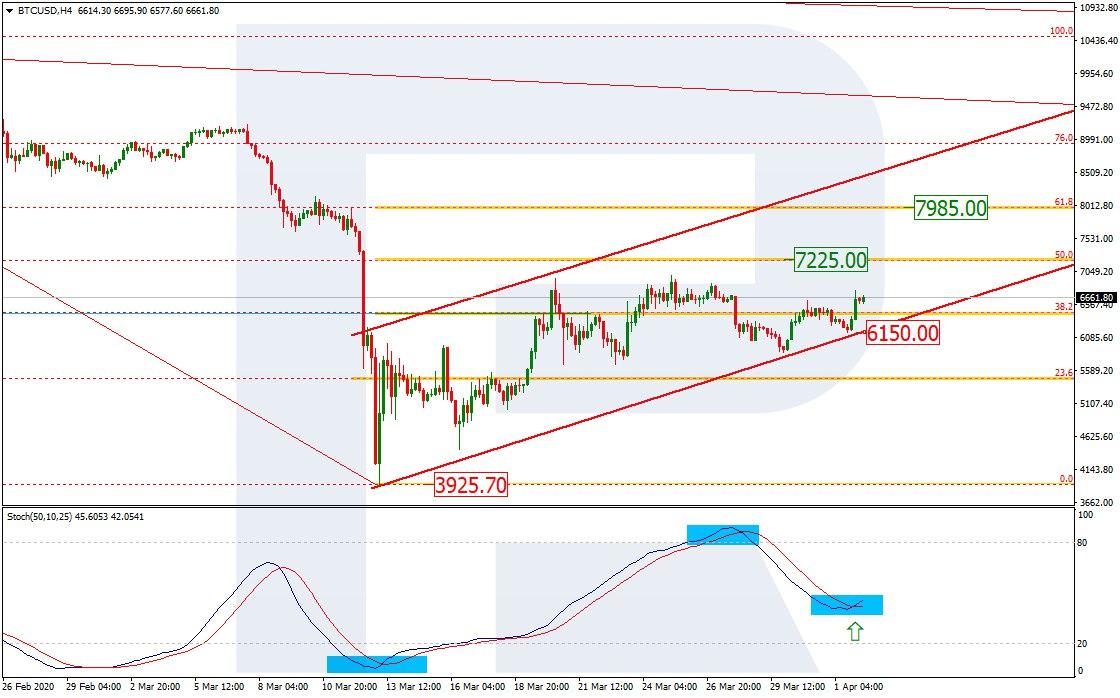

Photo: Roboforex / TradingView

On H4, the correctional uptrend can be seen in further detail. What is noticeable is the inner consolidation forming; it has been there for quite long already, which means it may soon be over and exit upwards according to the current trend. A Gold Cross on the Stochastic may signal and confirm the growth.

Photo: Roboforex / TradingView

According to the chart, in the last three weeks, the BTC rate grew by 76%, some 5% was added in the last 24 hours. From the local low of March at $3800.00 USD, the cryptocurrency has marched a long way, simultaneously increasing the trade volume (+117%). The global capitalization of the crypto market has reached 185 billion USD (+48%), the daily trade volume has also grown to 130 billion USD. The BTC share makes some 65% of it.

The crypto market keeps watching the fiscal actions of the US Fed which “has launched the printing machine” and is increasing the liquidity volume in its financial system. Keeping in mind that not only the Fed but also the European and some other central banks are sticking to soft monetary policy, the investors are sure that the USD and other currencies will be negatively affected. Hence, the digital money will get a chance.

However, judging by the Fear and Greed Index, the investing world is not ready to buy cryptocurrencies right now. The value formed by this index is 12 now, with the highest value of 100. Many do not trust this index, thinking it reliable for fiat assets but not digital ones. However, it is suitable for understanding the whole picture.

Disclaimer: Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.

[ad_2]

Source link