[ad_1]

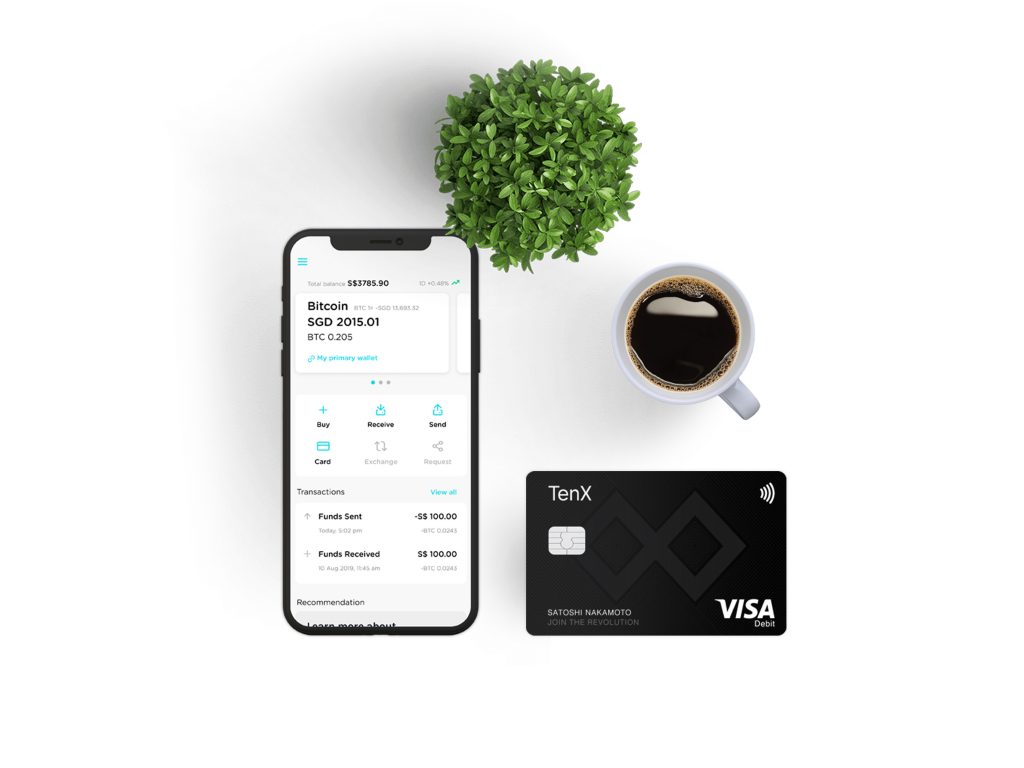

- TenX’s popular Visa debit card—which lets you spend cryptocurrency without having to manually top up—has launched in Germany and Austria.

- It supports Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), all of which can be spent anywhere that accepts Visa thanks to the card’s unique auto-convert ability.

In an ideal world, we’d be able to spend any cryptocurrency, anywhere we shop. But, in reality, merchants aren’t quite there yet. Luckily, TenX is here to help. Bridging the gap between blockchains and traditional fiat currencies, the TenX Visa debit card lets you spend cryptocurrency like it’s cash.

Following high demand, the card recently got the green light (in the form of an E-Money License) to launch in Germany and Austria, where it will serve a combined population of over 90 million people. So how do you know if the TenX Visa Card is right for you? Here, we’ll cover the perks of owning one to help you decide.

Move over, manual top-up: auto-convert is here

The TenX Visa Card does things differently. Unlike most competitor cryptocurrency cards on the market, which are essentially prepaid cards that you need to keep manually topping up with cash, the TenX Visa Card doesn’t need topping up at all. Instead, it auto-converts your cryptocurrency into cash at the very moment you make a payment.

“Part of the TenX mission is to help the world access cryptocurrency simply and safely, supporting users on their journey into the space by making it as easy to spend cryptocurrency as it is to spend cash,” says Toby Hoenisch, CEO and Co-Founder at TenX.

Whether you’re getting groceries in-store or renewing your Netflix subscription online, when you make a payment, the merchant receives it in their local currency. This instant, automated conversion allows for a seamless transaction—one that is just as easy as paying with a regular debit card.

Switching up your crypto spends

The TenX Visa Card and TenX Wallet App go hand-in-hand. When you make a card payment the funds come straight from your connected wallet app, with TenX working their magic behind the scenes to auto-convert your cryptocurrency. These payments can be tracked in-app (much like a neobank app lets you track your money), and you can also use it to lock your card should it go missing.

In the app there are three different wallets, one for each supported coin: Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). You can set any of these as your primary wallet—the wallet you make payments from—in the app settings, and TenX plans to add support for more cryptocurrencies in the future.

Anywhere Visa goes, TenX goes too

The TenX Visa Card enjoys all the features of Visa. Thanks to 3D secure—an added layer of real-time security—payments are protected against fraud. And, with over 54 million Visa-accepting merchants stretching across more than 200 countries, you can pay with your TenX Visa Card all around the world.

In addition, the card can also be used to withdraw money from ATMs, which is useful for traveling abroad or simply when you’re out and about. There is a fixed fee of $3.25 USD for doing this and, as usual, banks may also charge additional fees—so it’s wise to make yourself aware of this before you go ahead and withdraw any money.

Spend, buy, rinse, repeat

When you’re spending cryptocurrency, you’ll no doubt want to buy more. TenX has a solution for that too, as Toby explains: “We are thrilled to be able to once again serve customers in Germany and Austria. Our approach to re-launching our card is coupled with a brand new feature within the TenX Wallet app that makes buying crypto super simple.”

If you’re based in Australia or Europe you can benefit from this feature right now, with support for more countries in the works. Alternatively, no matter where you’re based, you can add more cryptocurrency to your TenX wallets by sending it from another wallet. It’s worth noting that here that, for the sake of security, TenX recommends you limit the amount of cryptocurrency held within your wallets to a week’s worth of expenditure.

Ready to become a TenX cardholder?

In light of the current economic climate, TenX is giving the Bitcoin.com community a boost by waiving its card issuing fee. This means, from now until May 31st, you can save $15 USD and get your TenX Visa Card for free using discount code TENXBCOM.

Your card is then free to use for the first year and, following that, it’ll remain free if you spend over $1,000 USD each year (otherwise there’s a small annual upkeep cost of $10 USD).

To get your TenX Visa Card, download the TenX Wallet App. If you’re located in a supported region (Germany, Austria, or Asia Pacific), you’ll be able to order it through the app. Otherwise, you can register your interest in-app to get notified when the card launches in your region.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer

[ad_2]

Source link