[ad_1]

The most recent Bank of America Fund Manager Survey shows that about three out of four professional investors think that bitcoin is a bubble. The fund managers also rated bitcoin second on the list of the most crowded trades. Recently, investment bank JPMorgan also warned that cryptocurrency as a sector is in a bubble.

Bank of America Survey Shows Most Fund Managers Think Bitcoin Is a Bubble

The Bank of America Fund Manager Survey for April shows that the majority of fund managers see bitcoin as a bubble. The survey asks 200 fund managers with $533 billion in assets under management.

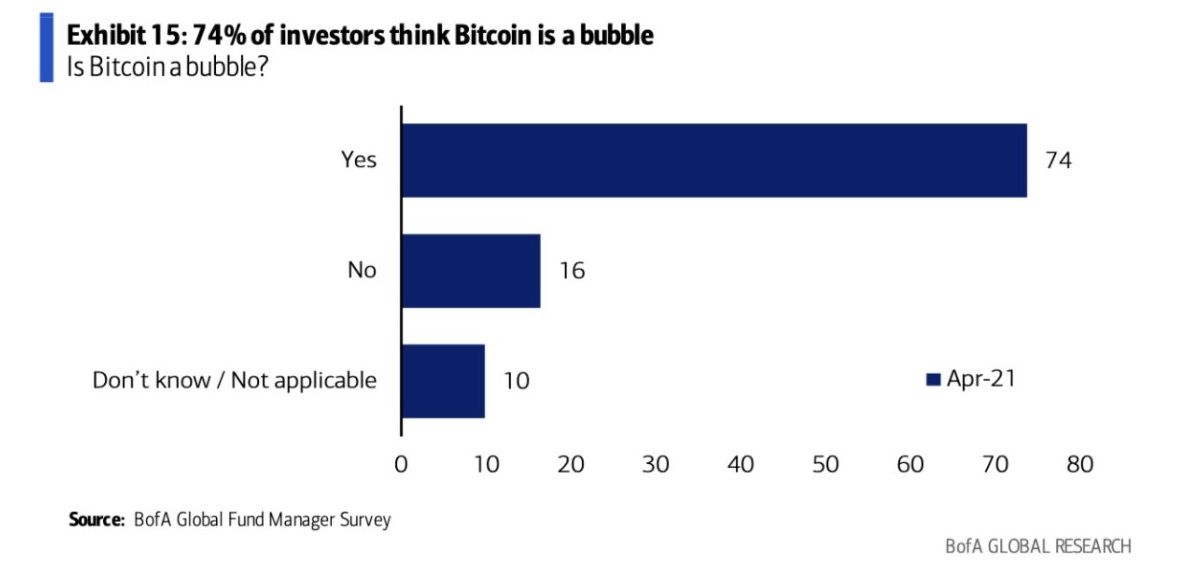

Answering the question of whether bitcoin is a bubble, 74% of investors replied “yes.” Just 16% said “no” to the question and 10% said they either did not know or did not want to answer the question. In comparison, only 7% of investors think that the U.S. equity market is in a bubble. Most respondents think that the equity market is in “a late-stage bull market.”

The fund managers who responded to the survey also rated bitcoin second on the list of the most crowded trades, with 27% said BTC was the most crowded trade. Technology stocks rank first with just over three in 10 respondents citing tech as the most crowded trade.

Nonetheless, about 10% of fund managers still believe that bitcoin will outperform in 2021.

Bank of America has been saying that bitcoin is in a bubble for months. Earlier this year, Michael Hartnett, chief investment strategist at Bank of America Securities, said that bitcoin looks like “the mother of all bubbles.” In March, the bank’s strategist said that the only good reason for holding BTC is “sheer price appreciation.”

Recently, investment bank JPMorgan also named cryptocurrency as one of the sectors it believes is in a bubble. Despite this view, the firm has predicted that the price of bitcoin could reach $130,000 in the long term.

What do you think about the Bank of America survey suggesting that bitcoin is a bubble? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link