[ad_1]

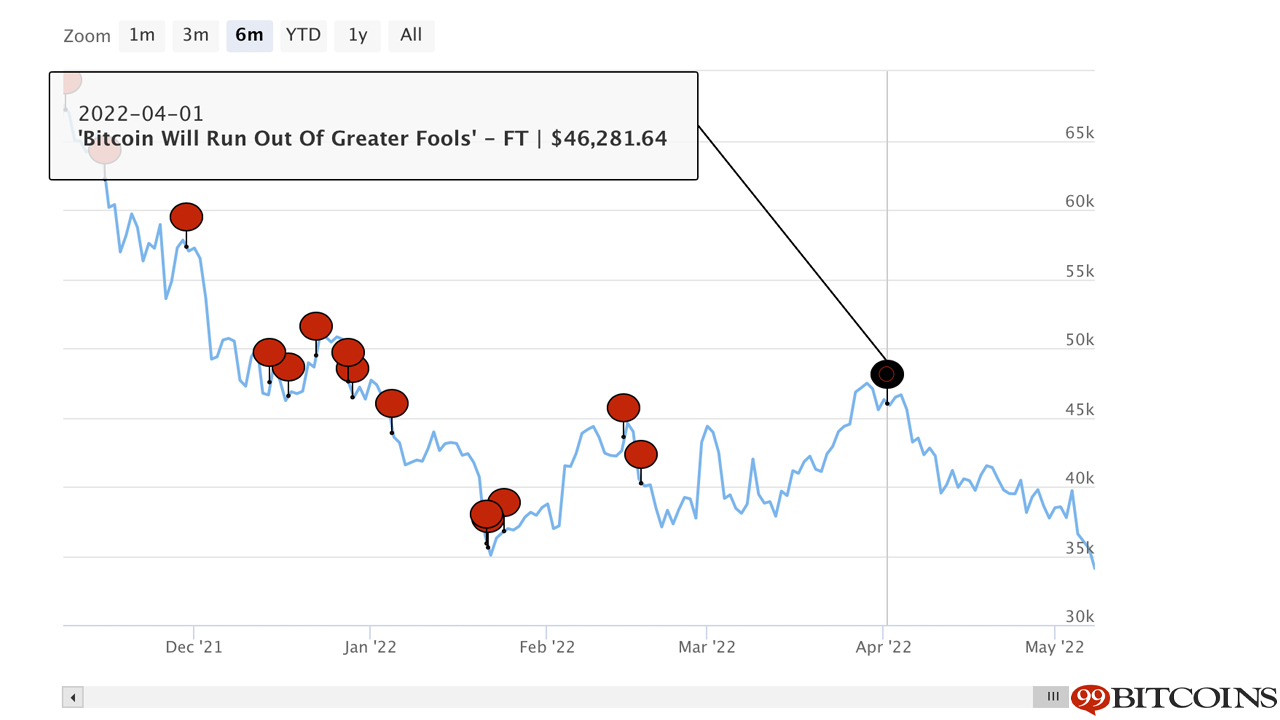

While bitcoin’s price has dropped to levels not seen since January 2022, a number of detractors think bitcoin is on its death bed. Data stemming from the Bitcoin Obituaries list shows the leading crypto has died seven times in 2022, outpacing the first three years of obituaries by year written by bitcoin haters. The last obituary written about bitcoin, opined by the financial journalist, John Plender, claims the leading crypto asset follows the “greater fools” scenario.

Bitcoin Obituaries List in 2022 Surpasses First 3 Years of So-Called Deaths by Year

During the course of Bitcoin’s 13 years, the leading crypto asset has been deemed ‘dead’ or ‘extremely close to death’ by many journalists, economists, analysts, and financial experts. In fact, these types of opinions happen so much, that the team at 99bitcoins.com curated a list called the “Bitcoin Obituaries.” The data from the website shows bitcoin (BTC) has died 447 times since the list was started in 2010. That particular opinion that said bitcoin was dead was written on December 15, 2010 in a post called: “Why bitcoin can’t be a currency.”

As the years continued, bitcoin obituaries were published more often, and during the bull run of 2017, there was 124 bitcoin obituaries added to the web portal. The following year in 2018, bitcoin died 93 times, and in 2019, only 41 deaths were recorded. 2020 saw a smaller number of bitcoin obituaries, as the year only saw 14 listed on the website. In 2021, bitcoin obituaries picked up the pace again, and the leading crypto asset saw 47 obituaries written about its so-called demise.

In 2022, there’s only been seven bitcoin obituaries recorded, but the year is not over and it has outpaced 2010, 2011, and 2012 by the number of yearly obituaries so far. Bitcoin’s price has experienced a downturn in recent weeks, and it’s quite possible even more bitcoin obituaries will be added this year. The last obituary listed on 99bitcoins.com was written by the British financial journalist and columnist for the Financial Times (FT), John Plender. The post listed as: “Bitcoin Will Run Out of Greater Fools,” quotes Plender’s statements from his April editorial. While Plender does not believe in bitcoin, the FT columnist does think blockchain is a powerful technology.

“There can be no denying the astonishing power of blockchain technology, which is here to last,” Plender writes in his FT editorial. “Yet bitcoin is intangible, risky and incomprehensible to most human beings. While it is increasingly gaining acceptance among professional investors, its performance this year makes it hard to believe it can topple gold from its position as the ultimate bolt hole for frightened money.” The financial journalist adds:

As for the important cultural dimension of the argument, bitcoin, frankincense and myrrh lacks a certain ring. The supply of greater fools will in due course run out.

Gold Bug Peter Schiff Says Sub-$10K Bitcoin Prices Are ‘Highly Likely,’ Schiff’s Recent Poll Shows 54% of 37,000 People Say They Will Still HODL

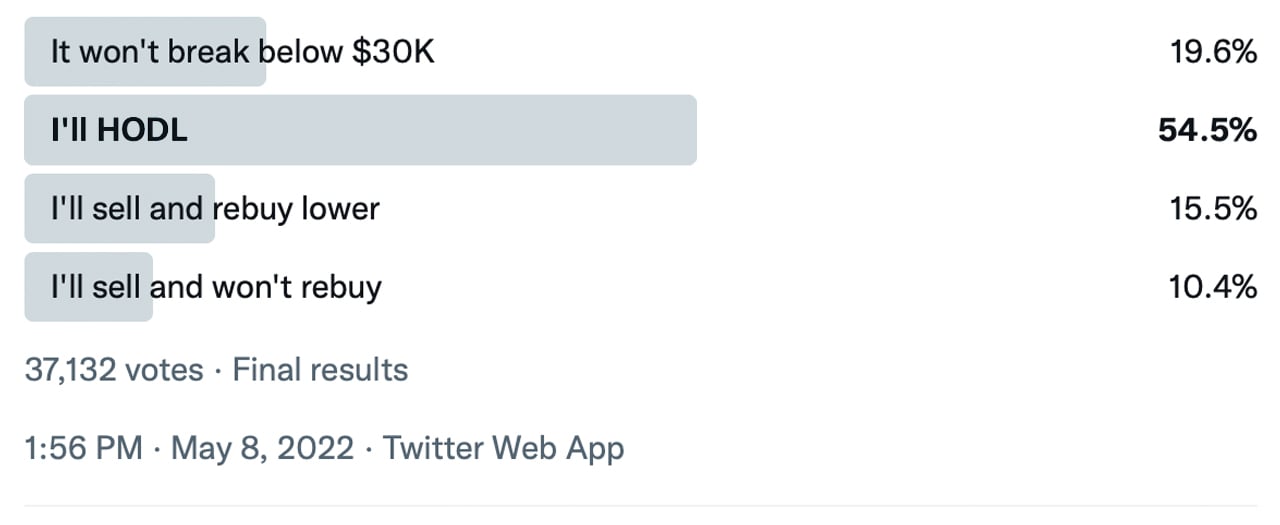

While bitcoin is not dead, the cryptocurrency still has many detractors like the Iranian-American economist Nouriel Roubini, and the economist and gold bug Peter Schiff. The gold bug Schiff believes bitcoin and other crypto assets will keep falling in value. Schiff recently held a poll on Twitter after he said: “If bitcoin breaks decisively below $30K it seems highly likely that it will crash below $10K.” Schiff then added that this means any BTC holder has an important decision to make. “What will you do?” Schiff asked. “You had better decide now so you don’t panic and make a rash spur-of-the-moment decision.”

Schiff then left a poll in his Twitter thread that gives people some choices on what they would do. Choice one was “it won’t break below $30K,” which received 19.6% of the 37,000 votes. 54.5% said they would “HODL,” and 15.5% said they would sell and buy lower. Roughly 10.4% of the surveyed participants said they would sell bitcoin and would not rebuy. In Schiff’s eyes bitcoin will always be dead, and he wholeheartedly believes the precious metal gold will continue to soar.

“The 6% weekend drop in bitcoin was in fact a leading indicator of weakness in other risk assets as stock market futures are trading down 1%,” Schiff said on Monday. “Once investors figure out that Fed rate hikes will result in recession but not a significant reduction in inflation, gold will soar,” the bitcoin detractor added.

What do you think about the Bitcoin Obituaries list hosted on 99bitcoins.com and John Plender’s opinion? What do you think about Peter Schiff’s opinion about bitcoin and his recent Twitter poll? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link