[ad_1]

While most of us sat watching the carnage with a mix of desperation and disbelief, according to data from CryptoQuant, many traders could have been spared. The latest bitcoin crash could have been predicted three days earlier. Here’s how.

Bitcoin Crash Was Easy to Predict from BTC Inflows

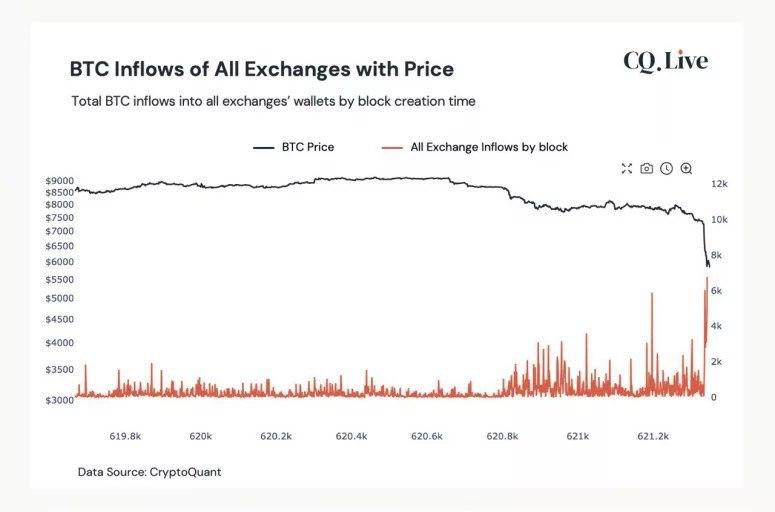

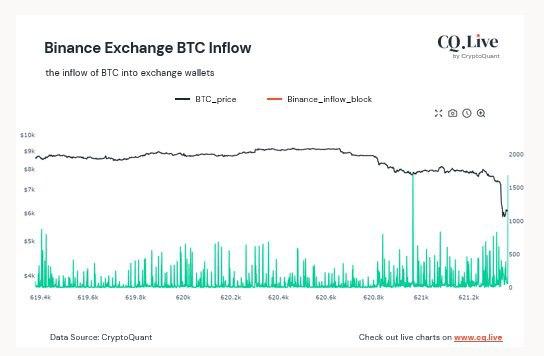

If you look at the chart below, you can see the volume of bitcoin inflows into all major exchanges before the crash. All inflows surged at around block 621.2K–a full three days before the actual dump. One suggestion is that this could’ve been a coordinated whale movement that initiated the mass sell-off.

In fact, even experienced cryptocurrency traders and analysts such as Josh Rager, also the co-founder at Blookroots.com, were saying it was “unlikely” that bitcoin price would tumble to the low $7000s. That was just hours before a 44% crypto crash that could have been foreseen by watching flows of BTC into exchanges.

The Trump effect is taking place on the market after his news conference

Bitcoin had a nice bounce in the $7500s, but it’s very likely price makes it way down to the $7200s-$7300s before another hard bounce

I have bids staggered from the $7300s down to $7100s pic.twitter.com/wFcoIW6Iwc

— Josh Rager 📈 (@Josh_Rager) March 12, 2020

BTC Inflows into Each Major Exchange

It’s curious that this mass coordination of movement of bitcoin just days before the dump wasn’t noticed by more people. Perhaps they were too busy reeling from the effects of Trump’s catastrophic national address or frantically stockpiling up on toilet roll. Maybe they were still clinging to the safe haven narrative or a little ray of hopium.

Because if there’s anything that trading and investing in the cryptocurrency space has taught us, it’s that large inflows of bitcoin to exchanges usually signals an impending dump.

Moreover, as you can see, this carefully orchestrated move by a group of whales allowed the funds to sit for a while and let the BTC price consolidate before taking dramatic action. How did this go undetected?

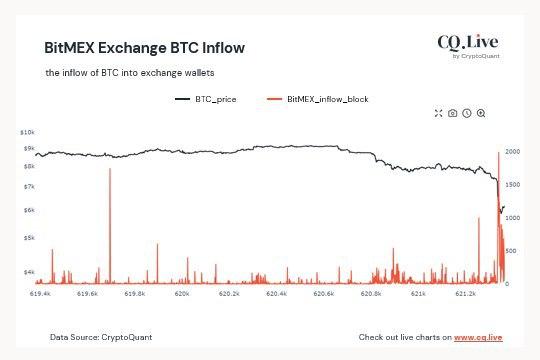

Take a look at the flow of bitcoin funds into the four major exchanges that each saw a huge spike in inflows at around the same time. Remember to keep your eye on the 621K block. The inflows are almost exactly the same. Here’s BitMEX:

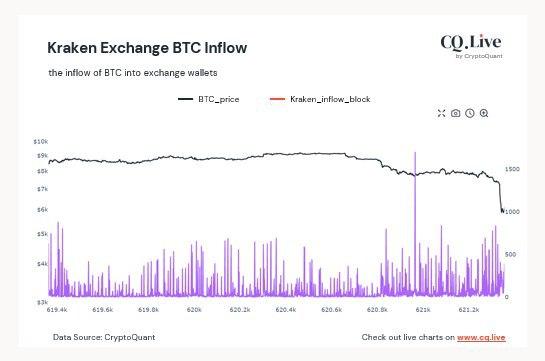

This is Kraken:

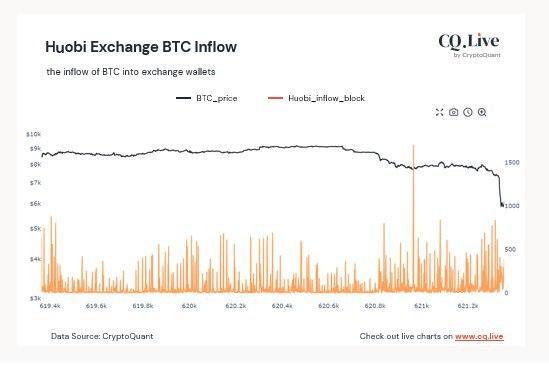

Now check out Huobi:

And finally Binance:

What gives? Bitcoinist asked CryptoQuant for comment, the company stated:

In the few days before the recent collapse in price, BTC inflows to exchanges increased. This can be taken as a signal that large holders were preparing to sell their coins. Signals like this can be taken as risk indicator, signaling to investors that volatility is incoming and to hedge properly.

In other words? Massive coordinated market manipulation by a bunch of whales. And the worst thing of all? We were all too busy looking everywhere else to notice.

What do you make of CryptoQuant’s findings? Let us know in the comment section below!

Images via CryptoQuant, Shutterstock, Twitter @Josh_Rager

[ad_2]

Source link