[ad_1]

OKEx surpassed BitMEX in the Bitcoin futures volume while exchanges face challenges in dealing with extreme market.

The cryptocurrency market fell prey to the global instability, which contributes to the catastrophic falling of Bitcoin, the largest cryptocurrency, from $9K level to $3k level. Starting from 7 March, the asset showed pressure on the resistance level, and continued the downwards trending until today, without indicating any strong bounce back signals yet.

OKEx Dominates the Bitcoin Futures Market

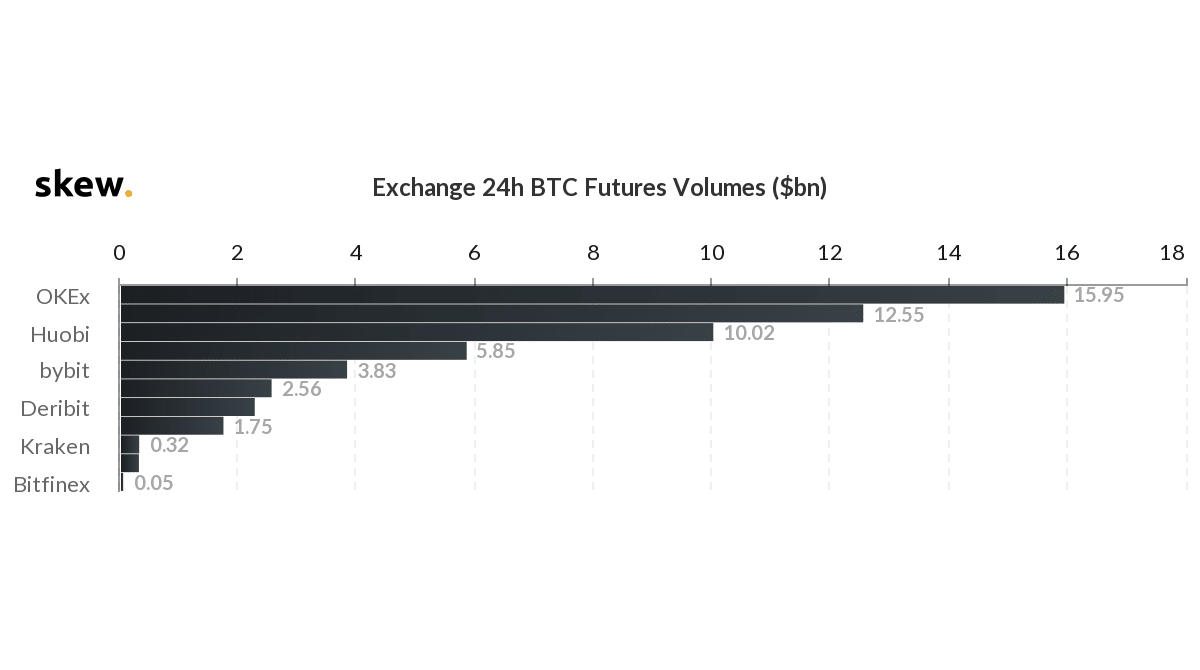

Despite the spot market is slowing down, Bitcoin’s derivatives market has been getting more attention, and the enthusiasm is quite visible in the Bitcoin futures market. Regarding the Bitcoin futures, BitMEX has been long dominated in the market, but now OKEx, another cryptocurrency giant, continues to closely follow BitMEx’s footprints and made a breakthrough in the Bitcoin futures trading volume. According to SkewAnalystics, OKEx outperformed BitMEX in terms of the 24h BTC Futures volumes, leading the Futures volume by reporting 15.95 billion, followed by BitMEX at 12.55 billion. Not only retail investors, but the flow of institutional capital is also tremendous in the market, which requires the crypto asset exchanges to have a professional and robust level of infrastructure to support the trading demands of the institutions, especially during the extreme market.

Photo: Skew

Exchanges Face Challenges in the Extreme Market

Recently, Bitcoin price experienced a significant plunge, and the market is under dramatic volatility. BitMEX announced on their Twitter to come across a system breakdown for a short period because of the hardware issue on their cloud service, resulting in a pause in trading on the platform.

Between 02:16 and 02:40 UTC 13 March 2020 we became aware of a hardware issue with our cloud service provider causing BitMEX requests to be delayed. Normal service resumed at 03:00 UTC. As a reminder, latest system updates can be found on our status page https://t.co/fVa1FAqSEW

— BitMEX (@BitMEXdotcom) March 13, 2020

Due to this instability, some users even complained never to trade again on BitMEX because the platform’s market makers are trading with the users during the breakdown.

I will never trade on Bitmex again. Unstable, “system overload”, while its own market makers are trading against the users.

Also, I got massively rekt during this crash lol. pic.twitter.com/glvSLn8Mqb

— ☣️ WALL/FACER 🔑 (@Stock_to_Flow) March 13, 2020

Similar issues happened on Binance, one of the world’s largest cryptocurrency trading platforms, and CZ, the CEO of Binance, also announced on Twitter regarding the latest maintenance both on their spot & futures trading system.

Bloodbath day.

🔶spot depth push experienced some delays, fixed

🔶futures UI 500 errors for a few minutes, fixed

🔶some futures ADL and margin calls, no cyclic crashes.Overall 5x system load than all previous peaks. Holding up so far, monitoring all systems.

— CZ Binance 🔶🔶🔶 (@cz_binance) March 12, 2020

It is notable that CZ mentioned the futures ADL (auto-deleveraging) which is a method of counterparty liquidation when the insurance fund stops working, meaning the profitable users need to share part of the profits with the losing users. As Binance mentioned, they have used half of their insurance funds to reduce ADL, and they will inject new funds if it is used up.

The #Binance Futures Insurance Fund has used over $6,000,000+ in the past 24 hours reducing ADL’s.

In the event that the insurance fund continues to deplete, we will inject new funds and continue protecting our users.

Sign up to #BinanceFutures here:

➡️ https://t.co/jkiHuCnnVe pic.twitter.com/ISzDtahFGx— Binance (@binance) March 13, 2020

However, Jay Hao, CEO of OKEx, another crypto exchange giant, holds different opinions by highlighting “In the past 24 hours, OKEx has achieved: 0% clawback in all markets and all pairs, and 0% ADL in profit trades.” From the data shown on OKEx website, it seems the insurance fund flow on the platform is more stable than Binance, implying OKEx hasn’t contributed the insurance fund to offset the losses. To explain, Hao mentioned it is equally important to protect users’ funds and their profits.

Another matter I wanna highlight here: platform risk management. In the past 24 hours #OKEx have achieved:

– 0% clawback in all markets and all pairs

– 0% ADL in profit tradesWe protect users funds and their profits, equally important. pic.twitter.com/kxwWNe3fGl

— Jay Hao (@JayHao8) March 13, 2020

On the other hand, the CEO also mentioned OKEx’s trading service is quite stable without any maintenance during the extreme market except the APP didn’t work for a while, and processed almost 300k orders/second. What’s more, Hao highlighted their API worked properly, and it should be great news to the institutional traders.

Having obtained a diploma in Intercultural Communication, Julia continued her studies taking a Master’s degree in Economics and Management. Becoming captured by innovative technologies, Julia turned passionate about exploring emerging techs believing in their ability to transform all spheres of our life.

[ad_2]

Source link