[ad_1]

Digital currency derivatives have been on fire during the last two weeks as ethereum futures volumes touched an all-time high on Sunday. The popular derivatives trading platform Deribit saw 1.9 million ETH contracts traded and CME Group is now the third-largest exchange in terms of bitcoin futures open interest.

Data shows that cryptocurrency futures and options are seeing significant demand in 2020. Statistics from Skew.com, CME Group, The Tie, and Deribit indicate a lot of action has been happening in the land of crypto derivatives.

Deribit’s recent newsletter shows that the exchange saw a new record in July as the firm saw $4.3 billion in options turnovers.

Another achievement the Deribit’s exchange saw was the platform’s overall open interest touched a whopping $2.3 million.

A large portion of the crypto derivatives trade volume stems from ethereum markets as Deribit recorded 1.9 million ETH contracts traded in July. On August 4, Skew.com wrote that “options-based probability of ETH > $960 at year-end = 5%”

The data and analytics firm Skew.com recently tweeted that ETH futures touched an all-time high on Sunday.

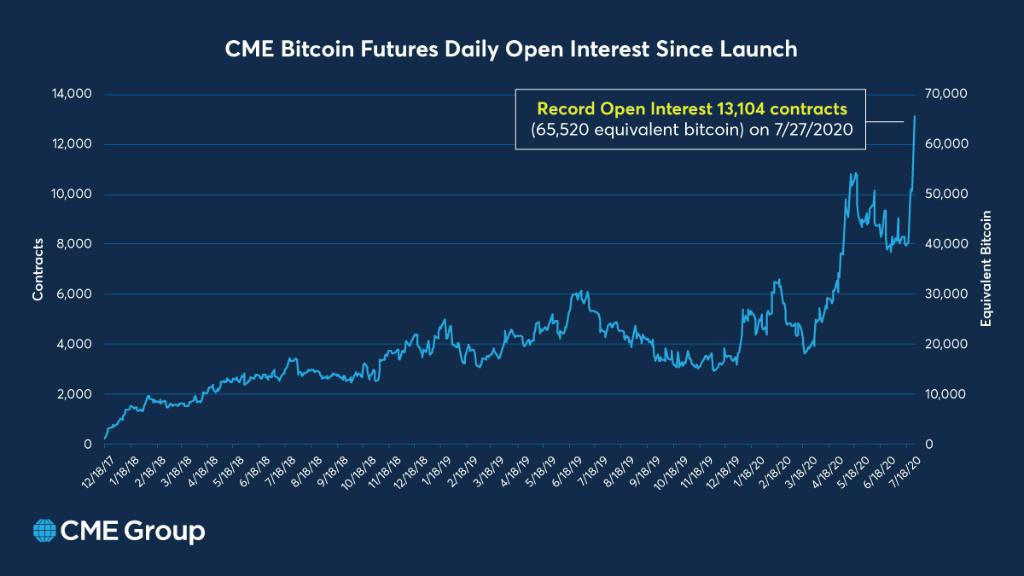

Additionally, the researchers noted that the regulated Bitcoin futures exchange CME Group “is now #3 in terms of largest open interest for bitcoin futures, only Okex and Bitmex are ahead.”

Last Wednesday CME Group tweeted:

Institutional interest in bitcoin futures is growing, setting a new open interest record of 13,104 contracts.

“As the next wave of more sophisticated participants enters the crypto space, volume will inevitably shift towards safer, more trustworthy venues,” Tim McCourt of CME Group said last week addressing the interest during an interview.

Moreover, bitcoin traders were concerned about a gap on the CME Group futures chart between $11,450 and $11,600. However, after Sunday’s 10.9% slide in BTC value, the bitcoin futures gap on CME had filled.

Skew also revealed on Saturday that “cash and carry with bitcoin futures, now yields 25%.”

“September futures trade at a significant premium to spot, including on CME,” Skew tweeted. “The industry is historically crypto rich and fiat poor, it seems USD is still challenging to source and will likely drive borrowing rates higher.”

With a lot of demand stemming from crypto futures and options markets, a great number ETH and BTC traders seem bullish. Data stemming from the researchers at The Tie shows BTC and ETH long-term sentiment scores have set new highs.

What do you think about the bitcoin futures open interest and ethereum futures demand? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Skew.com, The Tie, CME Group, NYSE

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link