[ad_1]

Grayscale Investments has posted a record quarterly performance, having added almost $1 billion, which nearly doubled its previous quarterly high. 84% of the investments were from institutional investors. The cumulative investment across all of its crypto products has reached $2.6 billion.

Grayscale Posts Record Quarter

Grayscale Investments released its second-quarter performance report on Wednesday. The company wrote:

Grayscale recorded its largest quarterly inflows, $905.8 million in 2Q20, nearly double the previous quarterly high of $503.7 million in 1Q20. For the first time, inflows into Grayscale products over a 6-month period crossed the $1 billion threshold.

“Grayscale Bitcoin Trust and Grayscale Ethereum Trust both experienced record quarterly inflows of $751.1 million and $135.2 million, respectively,” the report continues.

The majority of the investment, 84%, came from institutional investors, dominated by hedge funds, the company added. New investors accounted for $124.1 million of inflows and 57% of the investor base in the quarter.

The total investment into Grayscale products for the first half of this year amounted to $1.4 billion, and the cumulative investment across all of its crypto products since inception has reached $2.6 billion.

The firm’s total asset under management (AUM) as of July 15 is $4.1 billion. The Bitcoin Trust has the most AUM of more than $3.56 billion, followed by the Ethereum Trust with an AUM of $416.7 million.

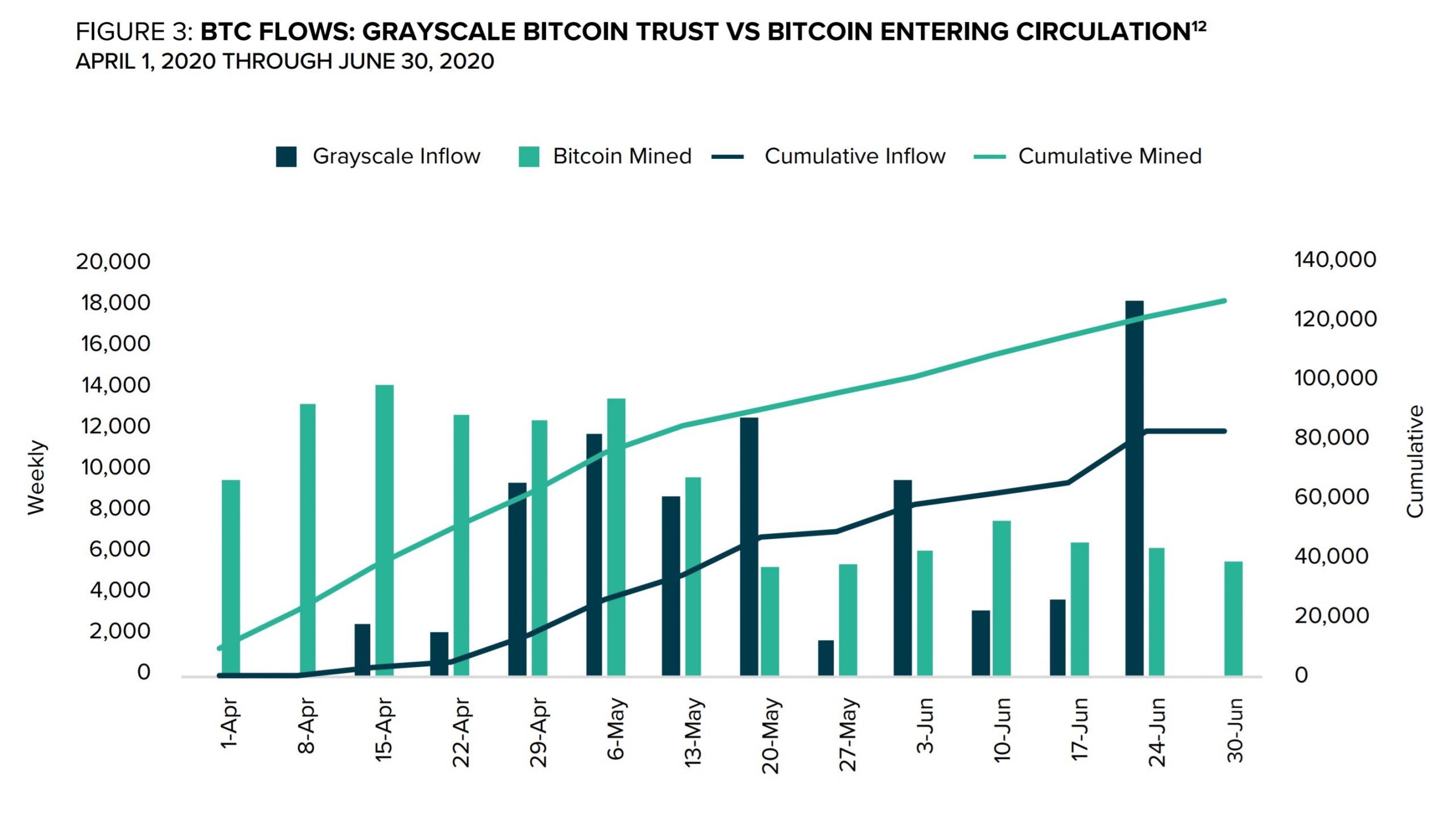

The report also highlights that “Grayscale Bitcoin Trust inflows exceeded newly mined bitcoin.” The company elaborates: “After Bitcoin’s halving in May, 2Q20 inflows into the Grayscale Bitcoin Trust surpassed the number of newly-mined bitcoin over the same period. With so much inflow to Grayscale Bitcoin Trust relative to newly-mined Bitcoin, there is a significant reduction in supply-side pressure.” News.Bitcoin.com previously reported that the company added 1.5x the amount of new bitcoin mined after the halving.

Grayscale offers 10 cryptocurrency investment products: Bitcoin Trust (BTC), Bitcoin Cash Trust (BCH), Ethereum Trust (ETH), Ethereum Classic Trust (ETC), Horizen Trust (ZEN), Litecoin Trust (LTC), Stellar Lumens Trust (XLM), XRP Trust (XRP), Zcash Trust (ZEC), and Grayscale Digital Large Cap Fund.

What do you think about Grayscale’s performance? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Grayscale Investments

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link