[ad_1]

On-chain data shows some old Bitcoin supply has recently been moved into exchanges, something that could be bearish for the crypto’s price.

Bitcoin Exchange Inflow CDD Has Spiked Up Over The Past Day

As pointed out by an analyst in a CryptoQuant post, the long-term holders have deposited some coins to exchanges over the last day.

There are two relevant indicators here; first is the “exchange inflow,” which measures the total amount of Bitcoin being sent into wallets of all centralized exchanges.

For the second, there is a concept called “coin days,” which is used as a measure of the dormant supply on the network. Whenever 1 BTC sits still on the chain for 1 day, it accumulates 1 coin day. The total coin days, therefore, tell us how many days the supply has been left unmoved for.

However, when any coin that has accumulated some coin days shows some movement, these coin days reset back to zero, or are “destroyed.” The “Coin Days Destroyed” (CDD) is a metric that keeps track of the number of such coin days being reset across the network.

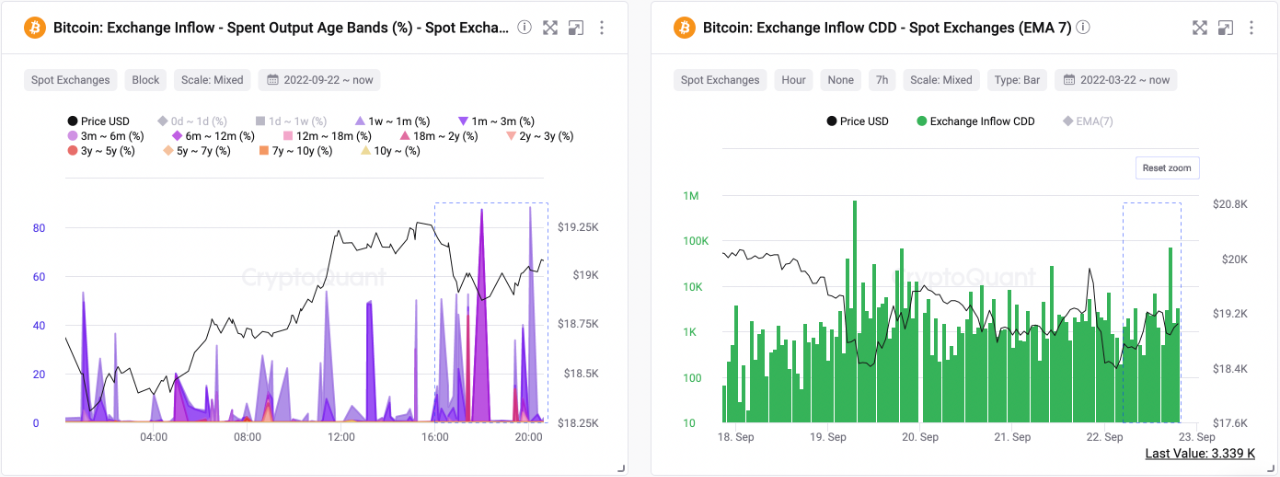

Now, here is a chart that shows the trend in the Bitcoin CDD specifically for exchange inflow transactions:

Looks like the 7-day EMA value of the metric has been elevated recently | Source: CryptoQuant

As you can see in the above graph, the Bitcoin exchange inflow CDD has observed a spike over the last day.

Since the indicator shown is just for the spot exchanges, these transactions were likely done for selling purposes as that’s what investors generally use these exchanges for.

Long-term holder group is a type of cohort in the BTC market which includes all those investors who hold onto their coins for a long while without selling or moving them, hence accumulating a large amount of coin days in the process.

As such, spikes in CDD generally suggest old supply (that is, the supply owned by long-term holders) is on the move. LTH selling has historically been bearish for the price of Bitcoin.

The last spike of a similar scale was seen just a few days ago, around which the coin’s price observed a short-term plunge down.

The chart also shows the trend in the Inflow Spent Output Age Bands, which is an indicator that highlights the individual contributions to the inflows coming from the different holder groups in the market.

It looks like a variety of cohorts have showed movement recently, with the long-term holders with 6 months to 12 months old coins moving an especially large amount.

BTC Price

At the time of writing, Bitcoin’s price floats around $18.6k, down 5% in the past week.

BTC continues to be rangebound | Source: BTCUSD on TradingView

Featured image from Hans-Jurgen Mager on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link