[ad_1]

The long-awaited Ethereum upgrade, the Merge, has been released. With the transition from PoW to PoS network, the Ethereum blockchain will become more energy efficient. Also, miners will cease to be the validators on the network. Instead, stakers will finally take over the validation and security maintenance role of the Ethereum blockchain.

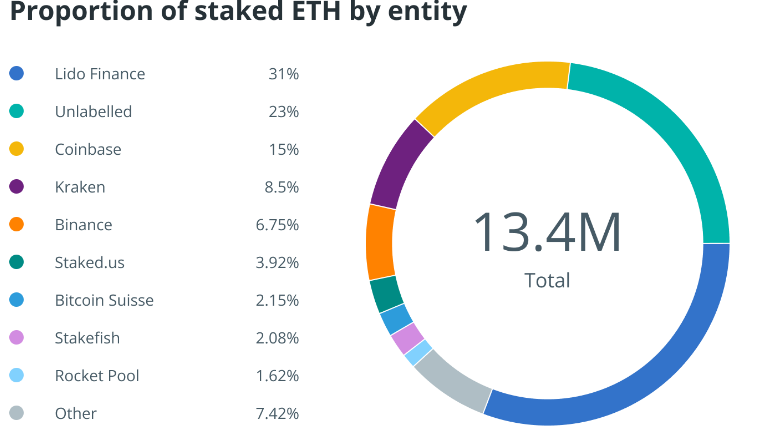

A blockchain analytics company, Nansen, gave a recent report on the distribution of staked Ether (ETH) and the significant holders. According to the report, five entities control up to 64% of staked ETH.

Lido DAO As Largest Holder Of Staked Ether

While outlining the details of its report, the firm noted that Lido DAO stands as the largest staking provider for the Merge. The DAO has about 31% share distribution of all staked Ether.

The next three more significant holders are the popular exchanges Binance, Kraken, and Coinbase, with a combined share of 30% of staked ETH. Their respective proportions of staked Ether are 6.75%, 8.5%, and 15%.

The fifth holder, tagged as ‘unlabeled,’ is a group of validators. The group controls about 23% proportions of staked ETH.

Also, the analytics firm reported on the liquidity proportions of all staked Ether. It disclosed that only 11% of the cumulative circulating Ether is staked. 65% are liquid from this staked value, while 35% are not. The report from Nansen added that the Ethereum blockchain has a total of 426 thousand validators while depositors are 80 thousand.

The development of Lido and other DeFi on-chain liquid staking platforms is for a specific agenda. First, they are to counter the risk from centralized exchanges (CEXs) as the latter amass more significant proportions of staked ETH. This is because the CEXs must operate under the regulations of their jurisdictions.

Need For Fully Decentralized Platform

Hence, DEXs such as Lido must be fully decentralized to resist censorship continuously, per Nansen’s report. However, the data from the on-chain firm showed a contrary stance for Lido.

The data indicated that the ownership of Lido’s governance token (LDO) has a tilt. Therefore, the groups with bigger token holders have more risk of censorship.

The firm cited that the top 9 addresses of the Lido DAO control 46% of the governance power. This signifies that just a small number of addresses are the dominants of proposals. So, there’s a need for sufficient decentralization for an entity such as Lido with the most considerable proportions of staked Ether.

Additionally, the analytics firm mentioned that the LIDO community is already making moves to prevent over-centralization risks. For example, it has plans involving dual governance and creating proposals for legal and physical distributed validators.

Also, Nansen highlighted the non-profitability of the majority of staked Ether. But it noted that illiquid stakers still hold 18% of staked ETH, which is in profit.

The firm mentioned that these stakers would likely engage in massive sell-offs when withdrawals become possible. However, the move will take about 6 to 12 months following the Merge.

Featured image from Pixabay, chart from TradingView.com

[ad_2]

Source link