[ad_1]

Bitcoin remains on an upward trend after breaking through $40,000 once again. However, this upward trend has not translated onto on-chain metrics. While the price of the digital asset continues to sit in the green, on-chain metrics have plummeted paining an entirely different picture in relation to price. From miner revenues to transaction fees, the decline is prominent.

Miner Revenues Drop

Bitcoin miner revenues have been up for the better part of last year. This followed even through the low markets at some point. But with the new year, as with many changes being experienced by the digital asset, bitcoin miner revenues have also taken a hit. Although they continue to be a significant amount, it is down for the month of February along with other metrics.

Related Reading | Exchange Inflows, Outflows Shows Investors Have Not Given Up On Bitcoin

Bitcoin miner daily revenues are now down to $34.6 million. This is a 14% decline that is attributed to the slower than average block production rate that has been recorded in previous days. It is also a direct result of the low momentum recorded by bitcoin for the better part of last month, seeing miners recover lower revenues due to the dollar value of the cryptocurrency.

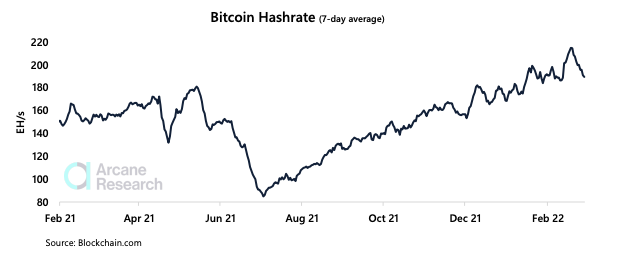

BTC hashrate down | Source: Arcane Research

Mining difficulty has increased, however, by 4.8%. It is the sixth upwards difficulty adjustment in a row and is the reason behind the slower than average block production rate given that increased difficulty means that miners find it harder to produce blocks. As a result, mining activities have become less profitable, causing many miners to turn off their machines and seize operations.

Following this increase in mining difficulty, the bitcoin hash rate has also suffered. In the last seven days of February, the hash rate had dropped by about 6%. The reduction in block production rate came out to a 5.3% decrease. Going forward, the mining difficulty trend is expected to reverse as a 2.5% decrease in mining difficulty is expected to occur on Thursday.

Bitcoin Transaction Fees Plummet

Bitcoin miner revenue has not been the only on-chain metric that has taken a hit recently. Transaction fees have not been spared either. This metric has been on a daily decrease for the past week, reaching as high as a 29% daily decrease in transaction fees.

BTC trending below $44k | Source: BTCUSD on TradingView.com

The last time that transaction fees have been lower than this was in the summer of 2020. Back then, on-chain activity had slowed to a crawl and the past week has recorded the same thing. It could be a direct result of the ongoing conflict between Ukraine and Russia. However, it could also be related to bitcoin investors reducing their activity in relation to the digital asset.

Related Reading | Bitcoin Holders Continue To Absorb Coins Dumped By Panic-Sellers

As for bitcoin, it continues to fight to stay at the $40K level. The cryptocurrency looks ready for another retest of the $44K resistance test after failing to secure a spot above it in the last two days.

Featured image from CryptoSlate, charts from Arcane Research and TradingView.com

[ad_2]

Source link