[ad_1]

A new study shows that ethereum is the most popular cryptocurrency among more than 4,000 adults surveyed in Singapore. The second-most popular crypto is bitcoin, followed by cardano.

Singapore-Based Crypto Investors Prefer Ethereum, Bitcoin, Cardano

The new 2021 State of Crypto in Singapore, a joint study by Seedly, Gemini, and Coinmarketcap, was published Monday. It contains a survey of 4,348 Singapore-based adults ages 18 to 65 across varying household incomes.

The survey was conducted between June 29 and July 9. It included 2,862 respondents who said they were current crypto holders and 1,486 respondents who said they were non-crypto holders. One in five crypto holders surveyed were women.

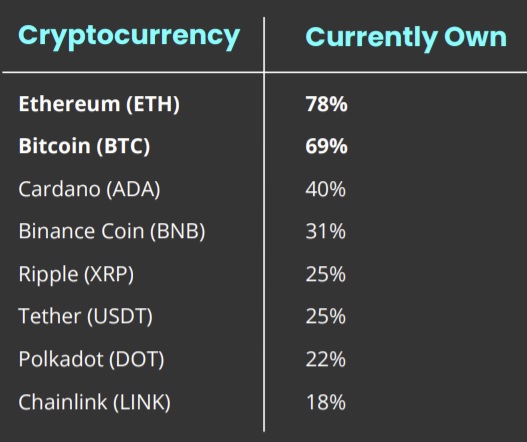

According to the survey results, 78% of respondents who had crypto said they owned ethereum (ETH), 69% said bitcoin (BTC), 40% said cardano (ADA), 31% said binance coin (BNB), and 25% said XRP. The report describes:

Of the 2,862 crypto holders, 2,236 of them are currently holding on to ETH. BTC is the second most popular cryptocurrency, with 1,975 of the crypto holders holding on to it. Coming in third and fourth are ADA and BNB , held by 1,141 and 893 investors respectively.

The report notes: “With ETH, BTC and ADA being the most popular cryptocurrencies across both genders, females actually hold and trade XRP and DOT [polkadot] more than their male counterparts. USDT [tether], on the other hand, is more popular among male crypto holders.”

Crypto investors also revealed how they were affected by the Covid-19 pandemic. The report notes, “Out of 2,862 people who invested in crypto, two-thirds of them invested more into crypto because of the Covid-19 pandemic.” The report adds, “The Covid-19 pandemic has spurred more Singaporeans to invest in crypto.”

What do you think about this study? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link