[ad_1]

The notorious dogecoin has seen double-digit gains this past week as statistics show the meme-crypto asset has gained 19.66% during the last seven days. Out of the top ten digital currencies in terms of market capitalization, dogecoin has outshined the competition, even surpassing ethereum’s 18% weekly gains.

Dogecoin’s Weekly Gains Outshine the Competition, Google Trends Data Shows DOGE Interest Dive-Bombed After May

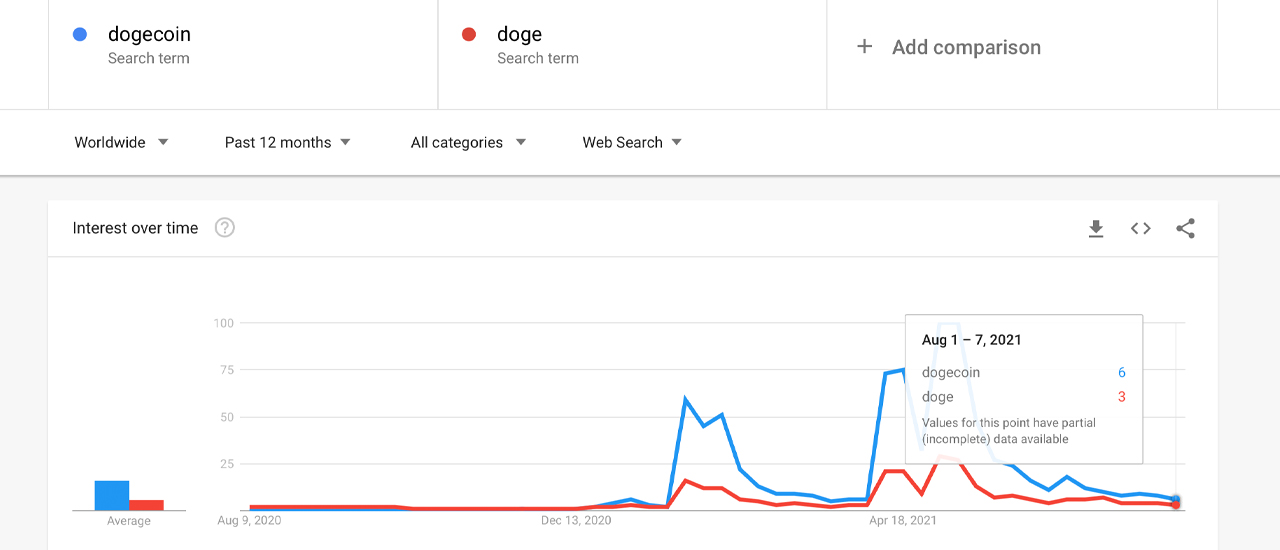

At the time of writing, both the topic dogecoin and the hashtag #dogecointothemoon have been trending on social media Sunday afternoon. As far as interest is concerned, Google Trends (GT) data shows that the search queries for the terms “dogecoin” and “doge” have dropped very low.

— Vikash Rao 🇮🇳🇦🇪 (@Vikash17971677) August 8, 2021

During the first week of May, the term “dogecoin” topped the highest score on GT with a score of 100, while the term “doge” hit a 29. Today, the query score for “dogecoin” is only 6 and the search term “doge” is 3.

Despite the drop, most crypto assets in terms of GT data that measures overall interest has dropped significantly. On the other hand, dogecoin (DOGE) markets have jumped considerably higher than most crypto assets today, capturing close to 20% in the last seven days.

Additionally if one were to compare 12-month statistics, in contrast to a great majority of the 10,000+ digital assets in existence today, DOGE has outshined them by a long shot. 12-month DOGE stats indicate dogecoin is up 6,849% on August 8.

Dogecoin has been trading for roughly 0.00000557 BTC per unit and the stablecoin tether (USDT) is the largest DOGE pair capturing 71% of all trades on Sunday. This is followed by USD (10.81%), BTC, (4.89%), BUSD (4.74%), and the Turkish lira or TRY (3.22%) dogecoin pairs. The sixth-largest trading pair with dogecoin (DOGE) is the euro with 1.75% of Sunday’s trades.

Dogecoin Is Down 67% Since All-Time High, Mystery Dogecoin Whale Absorbs 28% of the DOGE Supply

However, dogecoin (DOGE), out of the top ten crypto valuations today, is down lower than its all-time high (ATH) than the rest of the top ten pack except for XRP. Three months ago, DOGE tapped an ATH at $0.737 per unit and today it’s down 67% from the ATH.

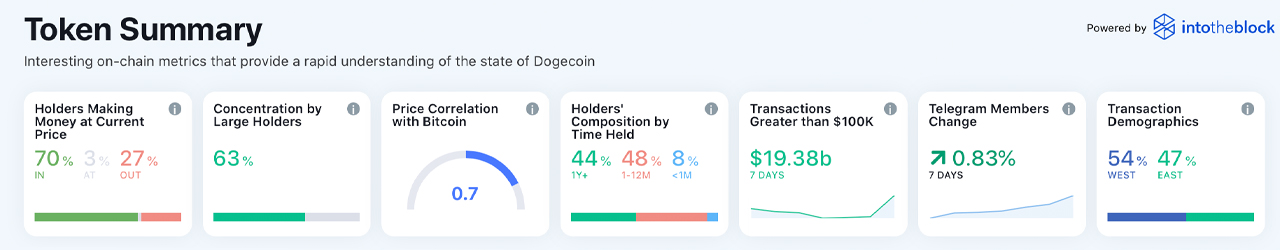

The biggest difference from DOGE, in contrast to XRP, is that XRP is not only down 76% today but that was over four years ago. Currently, 70% of dogecoin holders are making money at the current price according to Into the Block statistics.

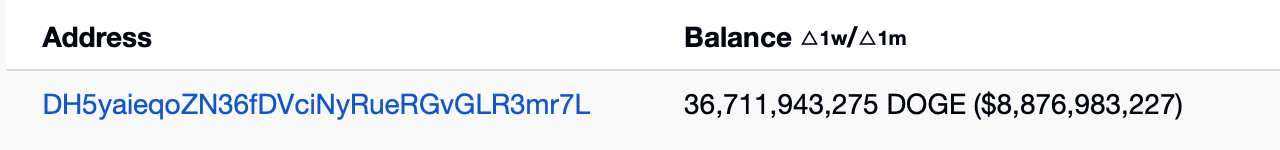

There is a concentration of large holders today as Into the Block statistics indicate DOGE is around 63%. Data from bitinfocharts.com’s richest dogecoin addresses show the mysterious “DH5” dogecoin address is still the largest DOGE holder today with 36 billion dogecoin.

This year, there’s been a number of theories that suggest the “DH5” dogecoin wallet belongs to Robinhood. At the time of writing, the “DH5” dogecoin address has managed to absorb over 28% of the entire DOGE supply.

What do you think about the weekly dogecoin (DOGE) gains and the mystery dogecoin holder with more than 28% of the supply? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, bitinfocharts.com, Into the Block, Bitcoin.com Markets, Google Trends (8-8-21)

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]

Source link