[ad_1]

The new Binance Card aims at the competition with brands like Coinbase Card. It can do everything you want, with additional features from the exchange.

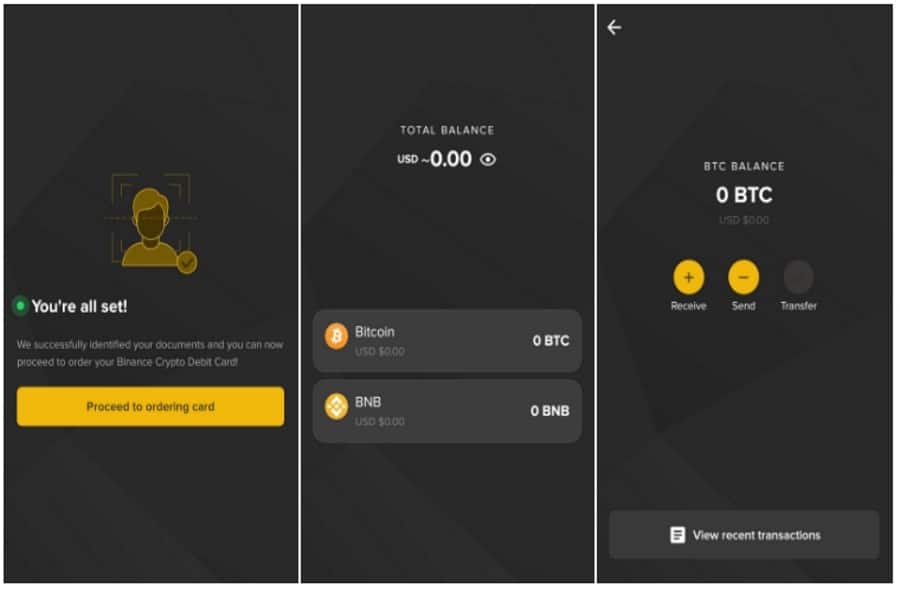

Binance Card is one more way of spending crypto without additional fees. You can top up the card using Bitcoin (BTC) or Binance Coin (BNB), right from the personal account. Use the mobile app to do the same. The card works via the Visa ecosystem, and valid in 46 million online and offline stores. The card will work in more than 200 countries, so the acceptance should start pumping up.

While the Coinbase card is working in the U.S. and some other countries, Binance Card develops a wider recognition model. Per the official Binance blog:

“At Binance, we’re always thinking about new products and services that will progress crypto further and make life easier for our users every day. Today, we’re delighted to take crypto adoption one step further and announce a product you’ve been all waiting for.”

The card’s main aim is to save the time of Binance customers. Why sending the cryptocurrency to the exchange, or waiting for a bank wire? The coins can safely land in the card’s balance the same moment the transaction gets three confirmations.

Binance Card Holds Balance in Crypto, Not Dollars

What is interesting, is that the card won’t automatically convert all the crypto you send to cash. Once you initiate a transaction, the card is taking a small bit of BTC or BNB from the initial account. Then you can keep holding the rest of the crypto, waiting for a sudden, bright morning:

“Buying gifts for your loved ones, shopping for groceries, or paying your internet bill online? The Binance Card does it all. No longer will you need to sell your crypto to pay bills. With the Binance Card, you can keep HODLing, and spend only what you need to make a payment.”

The Binance cards are in beta development now. However, the initial Card release will happen in Malaysia. Then, the cards will be shipped to Vietnam. The coming weeks will show, what do the users like in the service and outline the next list of countries. The card’s price is 15 USD, it’s a one time fee that you could pay simply via Binance app. Binance won’t be charging any of the monthly or yearly fees.

Photo: Binance Blog

When the card arrives at your home, simply use Binance Card App to manage the account. The spending will be as easy as hell. To activate it, send $15 or more to the card’s crypto account. When Binance processes a $15 activation fee, you’ll be set for spendings. This option brings a new push to a long-awaited adoption of Bitcoin. However, keep in mind the high network fees of Bitcoin may make some of your transactions slow. So, there is a path for improvements here, but the idea to turn Bitcoin into a tool of spending is very good. Because, as we see during coronavirus attack, Bitcoin can fall sharply together with other markets.

Jeff Fawkes is a seasoned investment professional and a crypto analyst covering the blockchain space. He has a dual degree in Business Administration and Creative Writing and is passionate when it comes to how technology impacts our society.

[ad_2]

Source link